One of the three purposes of a financial system is to join savers to investors, to allow funds to flow from people who have a surplus to those who have a deficit (the others are to manage risk and to facilitate payments). Investors are people or organisations which try to raise funds to put into projects which they hope will generate a return in future. Savers are people who have spare funds and will lend them, if they judge that the expected returns justify the risk. This post classifies funds raised by the length of time they are needed.

*

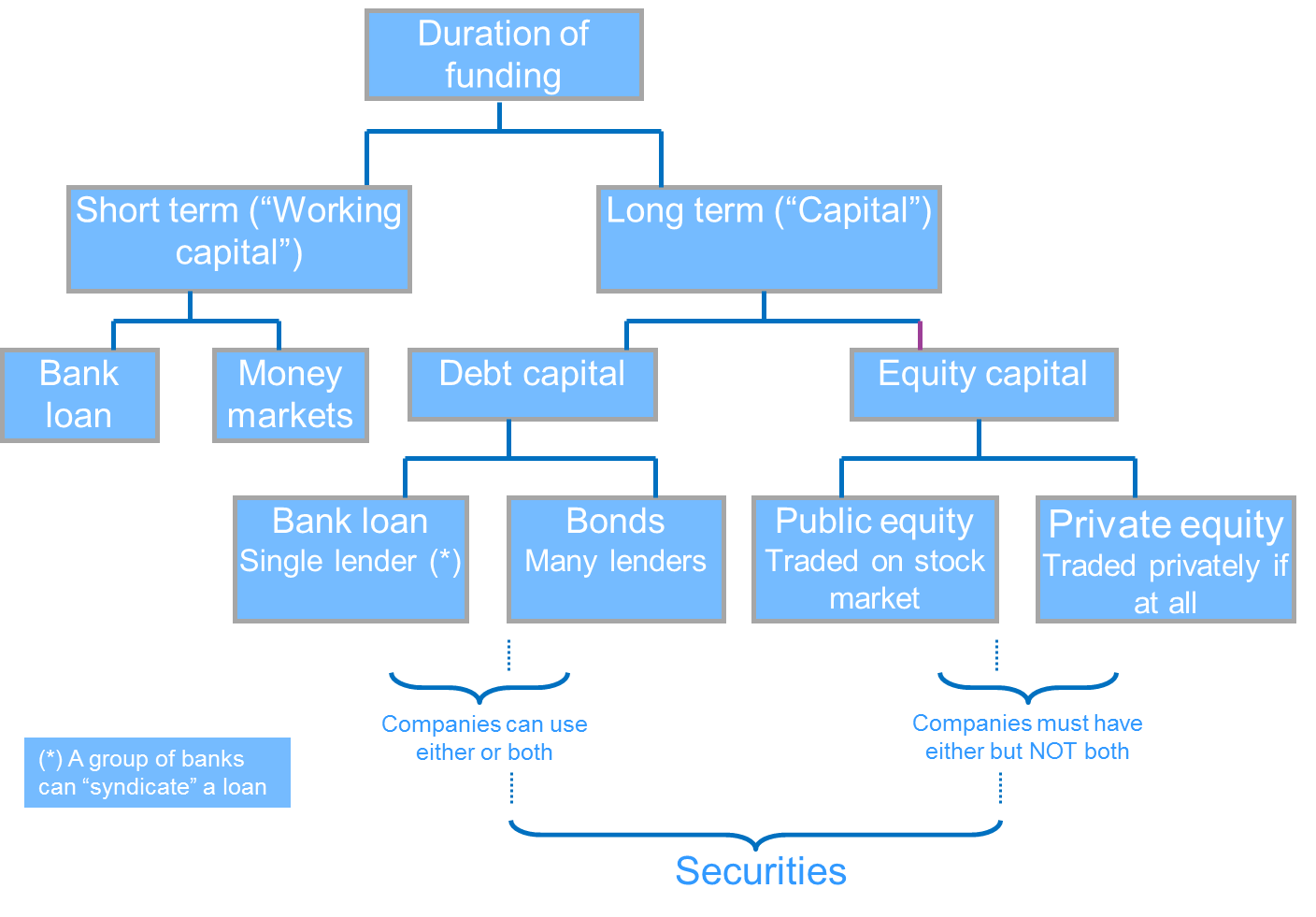

Companies and governments raise funds for many reasons and we can classify the funds in a number of ways, chiefly:

- the length of time they are provided (the duration or maturity)

- the nature of the contract between provider and borrower (is it debt or equity?)

- does the funding come from a bank or through the issue of securities?

Figure 1 shows a broad classification of different types of funding, starting with the duration of the funds.

Figure 1 Funding classified by duration

Working capital versus capital

The main distinction is between the length of time the funds are provided for. Businesses and governments have varying needs for funds through the year (we say their needs are “seasonal”). For example government tend to get their taxes in one period of the year, but their spending is spread out more evenly. So for some of the year the government has a deficit and for some it has a surplus. This would be true even if the government had no net deficit over the year as a whole (though that’s rare).

Companies have seasonal funding needs too. Many retailers get most of their business during key holidays such as Christmas or the Chinese spring festival. They have a surplus of funds at those times but a deficit at others.

So a business or government, even one that has no need for long term funding, may need funds temporarily during certain times of year. This is known as working capital. It means funding that would not be needed if there were no time lags between payments by creditors (those who the company owes money to) and debtors (those who a company is owed money by). But this is rarely the case.

Working capital is always in the form of debt, because it makes no sense for a lender to get involved in providing equity for a business if the need is only for a few months. A loan is much simpler and more suited to the need.

i) Working capital – funding for less than a year

Working capital can be provided either from a bank by a bank loan, or in the form of security. Bank loans are the main source for small and medium enterprises. For larger companies there is the option of selling securities in the money markets, which provide temporary funds to businesses and governments that are creditworthy and large enough. There are lots of money market products, which are covered on another blogpost. Unfortunately the word “money” in this context is unrelated to its more common use in the sense of cash and bank deposits. It’s just an historic usage that can lead to confusion.

One major form of money market product is the bill, which is an old word for a short term security. Treasury Bills are issued by governments. Commercial bills are issued by companies. The origins of bills lie in the Middle Ages when they were used for financing trade. Bill is of course also a word used in the US for banknotes and in the UK it means the cost of a service of product (equivalent to the “check” in US English). Bill is one of those words with multiple and sometimes related meanings which occur quite often in finance.

Banks provide revolving loans, meaning that they are available indefinitely or at least until the client no longer wants them, up to a predefined limit. These are suitable for a business which has varying needs through the year and can draw on the funds as needed. Small businesses may have to make do with an overdraft, the most basic and expensive form of unsecured loan.

Banks provide both secured and unsecured loans. It’s cheaper for a company to give security, if it can. Short term secured loans are made by banks and specialist financial institutions, where the security is provided by accounts receivable (money owed to the borrower by their customers) and stock. This form of funding is known as asset-based finance, which is NOT the same as asset-backed securities but the logic is the same, namely that there is some form of collateral that makes the loan less risky.

ii) Capital – funding for more than a year

Funds needed for more than a year are called capital. The word capital has a number of related meanings in economics and finance but they all contain the idea of something that takes time. Capital funds are usually intended for expanding or developing a business, or acquiring an asset with a long expected life – in sum, an investment in the future. As with working capital, funds can be provided by banks or by securities markets. Capital markets are those that provide longer funds. Alternatively, banks provide loans of a year or more in maturity, usually for a fixed period, known as a term loan.

Capital can be provided in the form of debt or equity (see Classifying funds by type of contract). Debt capital means long term lending, which can come from a bank loan or by issuing long term debt securities (known as bonds). Smaller companies usually have no choice but to use bank loans. Larger companies can issue bonds. A company is free to use both but since bonds usually have a lower interest rate than bank loans, those companies which can issue bonds typically do so and only use bank loans for short term or very specific purposes (such as a temporary loan to fund an acquisition, which will later be paid for by issuing bonds).

Equity capital is essential for any business – it must have at least some equity because that represents the owner’s interest. That equity can be kept private, meaning that it is not listed on a stock exchange and may not be traded. Or it can public, meaning that shares are listed (in an initial public offering or IPO) on an exchange, which allows other people to buy and sell the shares and provides liquidity to the owners. It also makes possible a takeover of the company and requires greater disclosure of financial information, so having public equity is a balance of costs versus benefits.

A company’s ordinary shares are either listed or they aren’t, so the company’s equity is either private or public – it can’t be both. It is possible to have two different classes of shares, so it would be feasible for one of these to be public and the other private.

FURTHER READING

Leave a Reply