The Federal Reserve, the US central bank, is making some changes to the measurement and monitoring of the short term interest rate between banks, which is its key target for monetary policy,

*

Most central banks have goals such as low inflation and high employment. After experimenting over the years with tools to achieve these goals, most now use the short term interest rate as their main target. But which short term interest rate?

In the case of the US, the Fed targets the effective fed funds rate (EFFR), which is the interest rate on overnight unsecured dollar borrowing and lending by depositary institutions (financial institutions authorised to take deposits – essentially commercial banks) plus certain other institutions allowed access to the market, chiefly government-sponsored entities such as Fannie Mae and Freddie Mac. The Federal Reserve’s New York branch authorises its dealing desk to intervene in the market to ensure that balance of demand and supply for overnight dollars is such that the price of those dollars (the fed funds rate) is kept where the Federal Reserve Open Market Committee judges it should be, to meet its inflation and employment targets.

The Fed is making three technical changes in its use of the fed funds target. One is the way that it sources the data for estimating the EFFR. Second is the way that data is turned into a point estimate. And the third is to publish a wider measure of the overall market for overnight demand and supply for dollars, which is broader than the fed funds market alone.

Sources for the fed funds rate

Currently the Fed gets data on the interest rate in the market from brokers who act between the buyers and sellers of funds. (A broker intermediates, for a fee, between two parties, not actually taking on any risk itself).

Following the LIBOR scandal and related scandals concerning the fixing of the price of foreign exchange, the Federal Reserve Bank of New York (the operational part of the Fed system) decided in February 2015 that it would move to collecting transaction-level data directly from the market participants themselves. There was no suggestion that the fed fund interest rate was being distorted or miscalculated but the FRBNY believed that it should move to follow emerging best practice in estimating such a crucial benchmark interest rate.

Changing the statistical estimation

The Fed has previously calculated a volume-weighted mean of the broker data on the EFFR. At the same time that it is moving to actual transaction data from the fed funds participants, it is shifting to a volume-weighted median estimate.

Anyone who does a basic statistics course learns that the mean and median (and mode) are different ways of estimating the central tendency of a statistical distribution. The mean is the sum of the observations divided by the number of observations, corresponding to what, in everyday speech, we tend to describe as the “average”.

The median is the central point of the data distribution, above and below which half the data points lie. The mode is the most commonly occurring data point.

Each has merits, depending on the data and on the purpose of the inquiry. But the mean is influenced more than the median by extreme values. So when describing the distribution of income,for example, analysts often use the median, which gets closer to what most people’s income is, rather than the mean, which is influenced by very high incomes of a few.

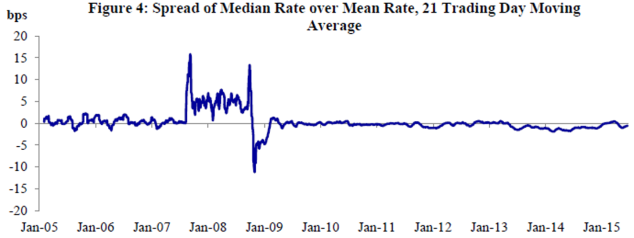

The mean and median EFFR are usually very similar, differing by one basis point (one hundredth of a percentage point). But during the financial crisis, when a wider and somewhat asymmetric range of EFFR was observed, the median appeared more representative because it was less influenced by the more extreme values (see chart below).

Most of the time, then, shifting from mean to median will make little difference. But in (hopefully rare) cases of financial instability the median should be a better guide.

Publishing a wider measure of overnight interest rates

In early 2016 the Fed will start publishing a new Overnight Bank Funding rate (OBF) alongside the EFFR. The OBF is a wider measure of the demand and supply for overnight dollars. It includes the Eurodollar market, which is much larger than the fed funds market, but offers an alternative source of short term dollar liquidity for banks.

Eurodollars refers to dollars held in non-US bank accounts. The market originated when US trade deficits meant that dollar claims on the US built up among foreigners. Some of these deposits (eg from receipts in dollars for sales of oil) were put into bank accounts in London. In the 1960s, oil exporters such as the Soviet Union, were worried about putting their dollars into onshore US bank accounts because they would be vulnerable to US government seizure or taxation.

Offshore US dollars were still dollars (liabilities of the Federal Reserve) but could be lent and borrowed in a new, unregulated market, free of domestic US rules and taxation. Since the pool of offshore dollars was originally in Europe (mainly in London) it became known as the Eurodollar market. The term has now changed to refer to any dollars held outside the US. There are also markets such as Euroyen and Eurosterling, which refer to other offshore currencies. These markets are global and no longer confined to London.

With the ending of most regulation and withholding taxes, an offshore dollar and an onshore dollar are now perfect substitutes and can easily move into and out of the US. So a bank in the US that needs overnight dollars can borrow them from the Eurodollar market, instead of the fed funds market.

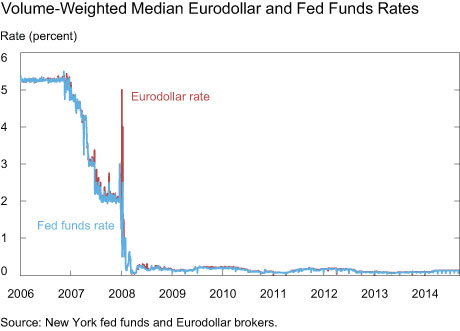

So the Fed has decided to show the interest rate for the wider overnight dollar market for banks. It rarely differs from the narrow fed funds rate, but during the crisis there was briefly a much higher rate (75 basis points – that’s a lot) for Eurodollars (see chart below). So there may be times when the wider OFR rate is a better guide to short term rates than the fed funds rate.

None of these actions imply changes in the target or conduct of US monetary policy. They just reflect the Fed (which is unfairly and inaccurately criticised a lot these days) trying to do its job responsibly.

Further reading from the NY Fed

The FR 2420 data collection: a new base for the fed funds rate

Leave a Reply