Since the collapse of communism, capitalism in its various different flavours is the only realistic option for countries wanting high living standards. But the US/UK variant is failing to deliver mass prosperity, which threatens to undermine it and generate a potentially ugly backlash.

*

The US, Sweden and Japan are all capitalist societies, meaning that most economic activity is carried out by the private sector, wealth is for the most part privately owned and the state intervenes only around the edges of the economy. There is a lot of variation in the institutions of each country and the scale of state-mediated income (what is often misleadingly called “welfare”) is quite different between the US at one end and Sweden at the other. In fact all rich economies are capitalist in my general definition and so are most emerging economies too. The state is more active in China and India but the bulk of economic activity is still private and both countries for the most part recognise and enforce private property. China has a Leninist political system, still confusingly called the Chinese Communist Party. But the operation of the Chinese economy bears little relation either to the USSR or to what little Marx wrote about socialist and communist economies.

And the reason for capitalism being the only game in town is that the communist economic experiment was such a spectacular failure. The key evidence is i) the failure of the USSR to come even close to matching US productivity and living standards; and ii) the natural experiment of partioning Germany into capitalist West and communist East, which led to the West vastly outpacing the East. You could also add the division of Korea into South and North, one a spectacular success in raising the living standards of its people, the other a tragedy. There are of course other factors but both theory and practice argue strongly against the success of an economy where the state tries to dominate decisions on investment and production with very limited scope for markets.

But the US and UK version of capitalism is showing signs of becoming unsustainable. Growing inequality, and the continued failure of the middle class to see any gains from economic growth, mean that the system appears to be working only for the richest. This cannot go on without some form of backlash, either through the electoral system (e.g. voting for politicians who promise to harm the rich, even if that doesn’t help the middle class) or through a potentially violent rejection of the private property system.

A recent, well researched and clearly written report by the Commission on Inclusive Prosperity, makes the case that the status quo is unacceptable and unsustainable. Co-chaired by Professor Larry Summers of Harvard University and Ed Balls, Shadow Chancellor (opposition party finance minister) of the UK’s Labour Party, the report lays out in detail the failure of the bottom 90% to gain from economic growth in the way that they used to. Ed Balls is a politician in a left of centre party but not remotely communist in his economics. Larry Summers is a mainstream US economist of exceptionally high standing who has been US Treasury Secretary (under President Clinton) and Director of the National Economic Council under President Obama.

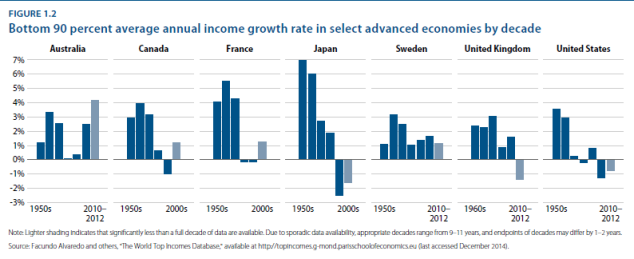

Here are three charts from the report. The first shows the slower growth of income for the bottom 90% of the income distribution in most rich countries. There are two exceptions, Australia and Canada, which may be owing to their economies being more dependent on natural resources than the rest. But for other wealthy countries there is a fairly pronounced slowdown in income growth from the 1950s and it is negative in some countries in recent years.

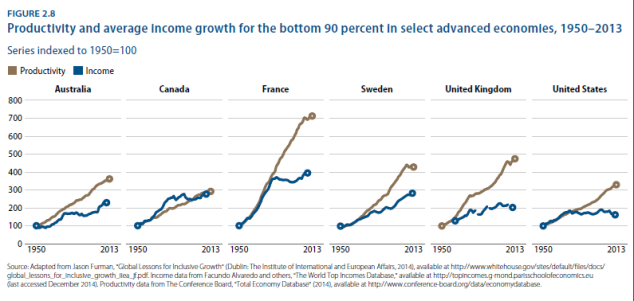

A second chart shows that this is in part because the long standing link between the growth of productivity and of wages has broken down, in several countries.

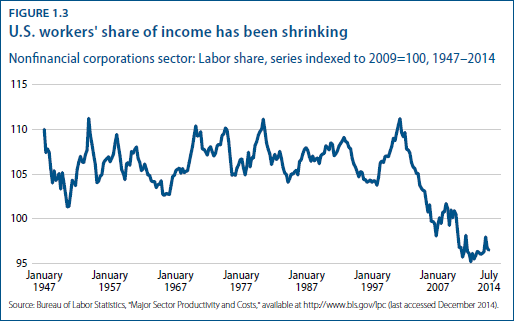

While in the short term productivity and wages can diverge, there should be a link in the longer term, as indeed there used to be. If wages aren’t rising as fast as productivity, it means that profits are rising faster instead. This is confirmed for the US in particular, where the third chart shows that the labour share of national income has been declining in the last decade, to levels not seen since before the second world war.

The facts are increasingly agreed. The causes remain contentious, not just because this is a politically sensitive topic but because there is a genuine puzzle about just what is going on. There are two main explanations, not mutually exclusive.

Globalisation and power

When China entered the world economy after the death of Mao, it brought a huge increase in the global workforce. It is not surprising that a rise in the relative supply of labour would temporarily depress the share of labour income globally, especially among lower skill employees in rich countries.

A related trend in globalisation is the ability of companies to operate complex but more efficient supply chains, linked by much more powerful information and communication technology. That means a tighter squeeze on the less efficient companies and less efficient (lower skill) people.

But it isn’t just the very low income people who are suffering, though it’s true that the growth of income is highest for those with more education. The median household (the middle of the income distribution) is also finding that job tenure is less secure and that income growth is increasingly a struggle. Household income growth has continued in the US mainly because more households have two people working. This is a good thing in many ways but it means that the middle class lifestyle enjoyed in the 1960s can now only be achieved by two people working, compared with only one before.

The second set of explanations lies in lower taxes for the rich (especially on capital gains but also income taxes and inheritance taxes) combined with a fall in rates of unionisation. A simple textbook view of labour markets regards them as just like the markets for apples or cars. But that is a very naive and simplistic approach. Power and politics matter and the US has been in the lead in a general trend to reduced union power in rich countries. Weaker unions have been associated with lower pay growth for the ordinary workers and higher pay for the top management (see below).

What to do?

These trends matter for at least three reasons. First, many people think it unjust that the distribution of income is becoming so unequal, even if it arises from neutral, technocratic factors (in my view this is not the whole story – power and politics are part of the explanation) . Second, a shift in income distribution towards the rich, who tend to spend a lower share of their income, risks causing a permanent gap in demand that means lower growth and higher unemployment, contributing to what Summers has called “secular stagnation” (for which there are other possible causes). Third, the rich themselves ought to be concerned that the system is not sustainable if only a small fraction of the population benefits from economic growth.

The report argues for increasing demand first, to restore full employment. Note that this problem is largest in the Eurozone where the policy of fiscal austerity championed by the European Commission threatens a long term slump with disastrously high unemployment. But the longer term challenge is to increase the productive capacity of the middle class, so they can earn higher incomes. Policies would include: better education and training; more investment in infrastructure; more support for innovation leading to more business start ups and accelerated productivity growth; and family friendly policies that help more women work, particularly better childcare for working parents.

These are all sound and quite familiar policies that have been pushed for some years already by “progressive” politicians in several countries. But the problem is more profound than this. A large part of the reason for rising inequality has been the enormous increase in pay of two particular types of people: finance sector employees and CEOs. Pay in the finance sector started rising much faster than in the rest of the US economy in the 1980s, as the finance sector itself grew faster, boosted by light regulation of markets and a big increase in leverage. That combination led to the financial crisis of 2007-08, which has been followed by an increase in bank regulation and some pressure on wages but not enough to reverse the trend.

CEO pay has exploded because of flawed corporate governance, in which boards take part in an arms race of competing stock-based compensation for essentially the same pool of CEOs as before, who are (in some people’s estimation) then driven to maximise short term stock returns that boost their option package value, rather than long term investment that boosts jobs and economic growth.

So many of these things are interconnected that it is very hard to be sure about the processes and causation in the economy. Globalisation, an underlying slowdown in growth rates and productivity growth in particular, lower infrastructure spending, higher rates of CEO pay, a larger role for the financial markets and the rise of China – this is a profoundly complex system which we don’t really understand very well.

Adding in the increasing ability of machines to do even quite sophisticated jobs, thus displacing even medium skilled workers, and you have a worrying situation. It’s most acute in the US and UK but it’s a problem shared in some degree across most of the rich countries. And there is no guarantee that middle income countries like China will be immune from this change in the way that globalised capitalism currently seems to work.

The Inclusive Prosperity report is a welcome, thoughtful and detailed analysis of the problem, with a long list of sensible policy measures. But I find its conclusions are not up to the scale of the problem, which is a very big one indeed. Along with climate change, this is the big challenge for rich countries, to determine what sort of economy and world we live in a decade or two from now.

UPDATE

Here is a very useful analysis by Jason Furman (the Chairman of the Council of Economic Advisers to the President of the US) of the slowdown in middle class incomes (the bottom 90%) for the US but with comparative data for other countries, showing that the timing varies but the overall pattern of stagnation (or even fall) is common across rich countries.

Ibrahim Abubakar

A very interesting and Insightful material. It made me visit my “Growth Economics” notes again. I can now see why capitalist economies rest on a Knife-edge in equilibrium.

Charles Wright

Great blog on a critically important subject….when will people realise that “business as usual” and unchanged regulatory settings will almost certainly in system crash. Imagine sailing a boat without ever changing the sail and rudder settings or driving on a mountain road without ever turning the steering wheel. Sometimes really dramatic action is required to avoid the tipping points that lead to catastrophic meltdown.

Most large private companies appear to have well developed contingency plans, yet governments do not.

For example, in Australia we have had a massive fall in iron ore and coal prices, which was flagged about 3 years out (in 2012). The AU dollar has then plummeted as well, as predicted for the last few years by the Reserve Bank.

So what has now happened to Government budgets and Private companies?:

Well, BHP Billiton and Rio Tinto have both ramped up there sales, stopped investing in new infrastructure, sacked a few workers, and INCREASED their profitability….their share prices have stopped going down and have stabilised: they are relaxed and comfortable

By contrast, the Australian Govt, The Queensland State Govt and the Western Australian State Govt have all gone into a budget panic and total deficit meltdown with mounting deficits projected to last for ever…..There mining income is gone!!!!!!

The contrast is mind boggling.