The asset management industry is huge, growing in size, especially in Asia, and increasingly dominated by a small number of giant companies.

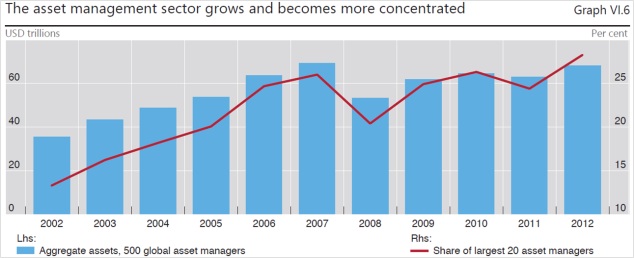

Asset management includes traditional “institutional” investors such as pension funds, insurance companies, mutual funds and money management companies, plus hedge funds. There are economies of scale in asset management: you can manage $1 million, $1 billion or $10 billion with roughly the same computer systems and staff. So there is a natural tendence towards concentration. The chart below, from the 2014 annual report of the Bank for International Settlements in Basel, confirms this. The top 20 firms account for about 28% of total funds under management.

The economies of scale are particularly powerful for passive investing, which is where the client gets low cost exposure to a whole asset class, such as the US equity market or global bonds. The fund manager makes no attempt to beat the market so doesn’t need any costly investment analysts. The service requires advanced IT but very few people and is almost infinitely scalable. So giant firms such as Blackrock get some of their advantage from being very large passive fund managers.

But there are pressures in the other direction. It’s hard to make good investment decisions and beat the market when you’re very large. Good investment ideas are hard to implement when you need to buy or sell very large amounts of assets. And many market imperfections which offer the chance of making money for clients only occur in smaller and less liquid markets. So hedge funds, which claim to be better than other investors at beating the market, are typically much smaller than institutional investors.

Most hedge funds are small, really small

We recently heard from an MFin City Speaker that 77% of all hedge funds had less than $100m under management. But those funds together only account for 3% of total hedge fund assets. By contrast the funds with more than $1billion under management make up 6% of all hedge funds but represent 80% of total hedge fund assets. So the hedge fund industry has a highly skewed size distribution. Those small funds are the entrepreneurs, trying hard to find a way to beat the market, create a good track record and then attract new funds. Evidently the great majority fail to do this, just as you’d expect in a highly competitive market where true skill (or luck) is rare. It’s hard to pay the fixed costs of running a fund, much less get rich, when you manage less than $100m.

For years the conventional wisdom in the asset management business has been a migration to a so-called bar-bell structure: a small number of very large, mostly low cost passive investment fund providers; and a large number of small but supposedly skilful active managers, either hedge funds or private equity firms. Medium sized active managers, lacking either scale economies or the skilful nimbleness of hedge funds, are supposed to get squeezed out of business in this story. It might be happening but it’s happening quite slowly. For the bar-bell scenario to happen, the ultimate clients have to realise that they’re better off with a combination of low cost beta funds and higher fee alpha funds. The evidence for the benefit of low cost passive investing is quite clear. The evidence for investing in high fee hedge fund and private equity funds is much less so.

Leave a Reply