Every year when the new MFin class starts, there is usually at least one person who asks the question: when will QE cause a big rise in inflation? The person is often from a hedge fund or trading background because that seems to be where this point of view is most commonly found. The assumption is based on mistaken economics, which I’ve written about before, here and here. In brief, the huge expansion in the US monetary base caused by the Fed’s QE programme of buying government bonds and mortgage backed securities is quite different from an increase in the money supply, which is the stock of bank deposits plus currency. There is no necessary link between the two and even if QE did lead to inflation the Fed would crush it, since their reputation depends on that more than anything else.

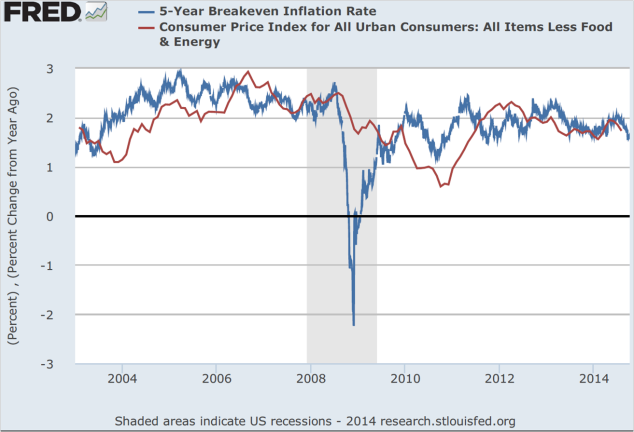

But rather than argue the theory or incentives, let’s look at the market, which may not be perfectly efficient but reflects the actions of people with actual funds at stake. The US government issues both conventional bonds and bonds which pay a return indexed to inflation, called TIPS (Treasury Inflation Protected Securities). The latter pay a real return, that is a return net of inflation. So the yield gap between the nominal (conventional) bonds and the real return bonds allows us to infer what the market expects for inflation. I’ve shown below the five year inflation expectations inferred from TIPS. You get similar results if you use the 10 year TIPS bond. I’ve also plotted the annual percentage change in the core consumer price index (the CPI less food and energy, which are relatively volatile and can obscure the underlying trend).

There is no evidence that inflation expectations have accelerated since the financial crisis (note the recession period marked in grey) or since the start of QE in 2009. Inflation and inflationary expectations were slightly higher before the financial crisis than now. The future remains to be seen but those who have been arguing since 2009 that QE would lead to rapid inflation need to re-examine their thinking.

Leave a Reply