Shadow banking is a term that was invented by Paul McCulley, the former chief economist of the giant fund manager PIMCO, in 2007. He was one of the first to identify and analyse the growth of chains of financial transactions in the US that had the economic substance of commercial banking but weren’t regulated, and often weren’t even noticed by regulators. Parts of this system went badly wrong in the financial crisis of 2007-09 and caused enormous damage.

The term has since become mainstream but is used in different ways even by speakers on the MFin. There is a broad definition and a narrow one. The broad definition is any financial intermedation outside the banks, and that is how the Financial Stability Board (based in Zurich and currently chaired by Mark Carney, the Governor of the Bank of England) measures it in an annual report. But that includes a wide range of activities that are benign, have no regulatory risk and need not involve lending at all. The more narrow and useful definition is any chain of financial transactions that has the substance of commercial banking, in particular matching short term liabilities against long term assets, without regulation or access to emergency liquidity, both of which true commercial banks do have. This is harder to measure but it’s what the word “shadow” is getting at.

The risk inherent in commercial banking

Commercial banking means financing loans from the taking of deposits. The deposits come from households and firms and the loans also go to households and firms. The circulation of financial flows from those currently with surpluses to those who want to borrow is at the core of a successful and useful financial system. Banks do this pretty well but they run an unavoidable risk in doing so. The typical depositor wants ready access to their funds, at short notice, without penalty. So deposits are a very short term and liquid liability of the bank: they must be ready to pay back some of these deposits immediately (“on demand”).

But the loans they make have the opposite features. Normally borrowers are unable and certainly unwilling to pay back their loans at short notice. On the contrary, many loans are for terms of several years. A mortgage loan is typically 25 or 30 years long. This mis-match between short term liabilities and long term assets is known as maturity transformation. It is socially very useful since without it long term loans would require long term depositors, who are very scarce. But it’s also risky.

The bank cannot ask for its loans to be repaid when its depositors want their money back. Instead the bank must keep some of its assets in a liquid form (cash, reserves at the central bank and highly liquid securities such as government bonds) so that it can meet the regular needs of depositors. But if the bank underestimates that demand or there is a “run” on the bank (everybody wants their deposits back at once) then the bank cannot meet this demand and risks going bust, even if the value of its assets is greater than its liabilities.

History shows this risk is real and that one bank failure can lead to contagion in which other, perfectly sound banks are also put at risk. So commercial banks are regulated. They are required to hold minimum levels of liquid assets, to have a minimum level of funding from equity and long term funds that cannot be withdrawn at short notice and under the new international regulatory rules known as Basel III they are also required to provide some matching between the the maturity length of their assets and of their liabilities (the net stable funding ratio). In most countries (China is currently an exception) there is mandatory deposit insurance that reassures depositors (at least up to a certain level of deposit) that they will get their money back even if the bank fails, thus reducing the risk of a bank run.

And if all else fails, a regulated commercial bank can get emergency funding from the central bank which should allow it to pay out any amount of depositors without having to sell its assets in a firesale and at great loss.

Shadow banking

The idea of shadow banking is a set of financial transactions or institutions that funds long term, illiquid assets with short term, liquid liabilities, just like a bank, but without the regulation and access to emergency liquidity support that a commercial bank has. This was first identified in the US but exists in some degree in many countries, most notably China. Importantly, shadow banking is not designed or constructed deliberately. In each case it has evolved, often without regulators noticing it until it has become systemically important i.e. big enough to cause macroeconomic trouble if it goes wrong.

The classic shadow banking chain in the US before the crisis was as follows.

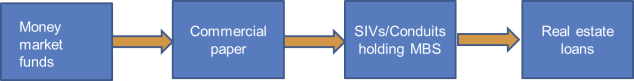

Households put their funds into money market funds, which they treated as very much like bank deposits. These funds put some of their money into asset backed commercial paper (ABCP), which is a short term security (an IOU) issued by an ABCP conduit. A conduit is a company (a special purpose vehicle) set up by banks purely for the purpose of transforming financial flows. The conduit used the resources raised from the money market funds to buy mortgage backed securities (MBS) which were securities whose valued depended on the payments by households who had taken out 30 year mortgages secured on real estate. The chain is shown in this figure.

The effect of the chain is to fund long term, illiquid assets (real estate loans) with very short term, liquid liabilities (holdings in money market funds). That is potentially unstable. If money market funds decide that asset backed commercial paper of this type is no longer reliable then they can stop buying it overnight, leaving the conduits unable to refinance their maturing commercial paper. This actually happened in 2007 after two hedge funds owned by Bear Stearns collapsed and BNP Paribas suspended one of its funds, all of these three having invested in MBS. Money market funds realised that the underlying loans backing the MBS and therefore the commercial paper financing them, were of poorer quality than they had thought. Demand for ABCP fell sharply. It took another tumble after the collapse of Lehman Brothers a year later in 2008 by which time the conduits were all ruined. Many were bought back by the commercial banks that had created them, most famously Citi, which lost tens of billions of dollars by bringing back onto its balance sheet risky assets which it had earlier deliberately sold on to the conduits.

Why did this chain arise?

Recall that nobody designed this system. But each person in the chain was making what seemed like a sensible decision. The households put their savings into money market funds, rather than into bank deposits, because they got what they thought was an absolutely safe home for their money (even though such funds are NOT insured like deposits) plus a slightly higher interest rate. The money market funds thought that asset backed commercial paper, which is actually backed by something tangible, unlike normal commercial paper, was safe. The banks that set up the conduits believed that default rates on the MBS would be low because the underlying mortgages were safe, since defaults on mortgages had been low for fifty years and house prices had never fallen across the whole US since the 1930s. The conduits, which allowed banks to get round regulatory rules on mortgage lending on their balance sheet, were profitable. MBS were a sensible way of increasing the flow of finance available for mortgages, thus lowering interest rates paid to households wanting to buy a home. Home mortgages were generally a secure investment and had very low default rates, so MBS attracted a wide range of investors.

Once it became clear that poor quality (“sub-prime”) lending had led to mortgages that were gravely exposed to what was evidently a national fall in house prices, the chain fell apart. The threat of trillions of dollars of funds being withdrawn from money market funds in 2008 led to the Federal Reserve making liquidity available to them, even though there was no previous arrangement for doing so.

The Chinese version

In China, years of government regulated interest rates on loans and on deposits have led to frustrated savers and borrowers. Savers want higher rates on their money and borrowers, especially private sector companies that have been denied loans by the government-owned commercial banks, are willing to pay higher rates to get loans. Shadow banking with Chinese characteristics arose to bridge the gap between these willing savers and borrowers, going round the banking system, though sometimes with the help of the banks.

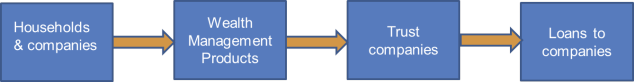

There are various channels in the Chinese shadow banking system. One is the existence of trust companies, which provide loans to companies but aren’t allowed to take deposits. So they aren’t banks. But they raise some of their funds from bank customers in the form of wealth management products (WMPs) which are savings products offered to households with the attraction of a higher rate of interest than on bank deposits. The banks themselves market these WMPs so they get a share of the profit on the flow of funds into the shadow banking system. So households are providing the resources for a chain of funding that ends up with corporate loans, often to real estate companies or secured on real estate. Once again short term liabilities (up to a year typically) are mis-matched with long term, illiquid assets.

It would be less of a problem if the households realised that they were lending against higher risk assets and they might not get their money back. But, like the money market savers, they believe (perhaps they are encouraged to believe) that their savings are just as safe as in a deposit account and are even guaranteed by the bank selling them the WMP. But these are very questionable assumptions. It may be (and in some cases this has happened) that the government forces the bank to make good any losses on the WMP, for fear of triggering a wider panic and sell off. But then the system has compounded moral hazard (encouraging reckless lending with no fear of losses) as well as making the banks potentially liable for losses they hadn’t expected.

Conclusion

Shadow banking arises when there are incentives to do so, mainly because regulation provides loopholes or inconsistencies that make it profitable to re-route funds flows out of the (relatively) safe regulated banking system. Financial innovation is often a response to regulation and some of it is potentially very helpful. But the unchecked growth of shadow banking was a major contributor to the scale of the financial crisis in the US and has amplified the problem of excessive credit in China.

Muhamad Nafi (naffyc)

Shadows are said to be black instead of red.

The nature of liquid assets are not quickly recognised as compared with long term assets [fixed or organic (as in goodwill & patents)] yield.

The bankers are shadowing the margins. Do you agree?