Economics students learn early in their microeconomics course that there is a desirable market condition called perfect competition, which consists of large numbers of more or less identical firms competing aggressively to meet the customer’s wants. The competition is so fierce that no firm has any ability to charge a price above the absolute minimum needed to stay in business. So the customer is assured of a low price and the economy makes efficient use of resources, since only the most cost effective companies can survive.

They then learn about how bad monopoly is. That is the opposite type of market in which there is a single supplier who naturally charges whatever the market will bear and has little incentive to be cost efficient or to be attentive to customer needs. A market with monopoly will be inefficient (*), will charge customers more than in perfect competition and probably won’t be innovative or offer a decent service.

The problem with this picture is that very few actual industries are like either case. Perfect competition is a fiction, an “ideal type”. The nearest we get to it is in agriculture and some other basic commodities, where the product is identical and firms have no market power or ability to add any sort of value or service that would merit a higher price. Many markets are competitive but with only a few companies, and the product is usually slightly differentiated.

Take coffee shops. There are plenty of choices for a customer in Cambridge looking for a coffee. There are the three big chains (Costa, Nero and Starbucks) plus various independents. All offer broadly the same product (though for my taste the brown milk that you get in Costa or Starbucks barely rates the name coffee) but they each have subtle differences in ambience, style, service and location. They compete on these features, not on price, but their products are broadly priced the same, which suggests some degree of restraint from competition.

That type of market is called monopolistic competition in economics textbooks because the product or service is not identical and each firm has some degree of influence over demand. Innovation is encouraged in that type of market because a small enhancement can cause customers to switch. But other customers are loyal or just conservative, which means that the coffee shops aren’t relentlessly trying to retain every single customer each day, which is the miserable fate of a company in a perfectly competitive market.

Pure monopoly in the sense of a single supplier is rare except in the natural monopolies of network utilities, where there is a strong cost argument for a single electricity transmission wire or water pipe. Competition would be wasteful and no new entrant would expect to make money. So these industries are inevitably monopolistic and are usually regulated as such.

But quasi-monopolies, in the sense of a dominant supplier, are quite common. And the goal of many businesses is precisely to try to establish such a position. Peter Thiel, the co-founder of Paypal and an early investor in Facebook, taught a course on start-ups at Stanford University in 2012 and this blog provides some notes on the course (it’s written by Blake Masters, Thiel’s co-author of the new book Zero to One so the notes are likely to be a reliable guide to what Theil said). One thing that struck me was his argument that successful capitalism and monopoly are not opposites, as the textbook view of economics might suggest. On the contrary, he argues that a start up should be intending to find or build a monopoly or at least dominant position that it can completely own. Unless a start up has that ambition or potential it’s not worth investing in or working for.

So monopoly is both the goal of a dynamic business and an outcome that reflects success. Perfect competition is neither a good guide to what most business looks like, nor a desirable goal that any business should accept.

Successful examples of quasi-monopolies would include Google, Facebook, LinkedIn and for a while Apple and Microsoft. None of these is or was a 100% monopolist, though Microsoft came very close with the dominance of Windows for a while. And none of them has an unassailable position, because technological change makes new disruptive entrants a possibility, which is why so few companies keep their monopoly position. In the past IBM dominated mainframe computers for about thirty years but now is just one of several consulting companies (though most of its erstwhile hardware competitors in the 1960s and 1970s didn’t survive). Apple seems to me to be in long term decline but from such a strong starting point that it will be profitable for a long time to come. Google is perhaps the one company most likely to remain dominant, in a way that is increasingly rather worrying and is creating some public perception problems for the management.

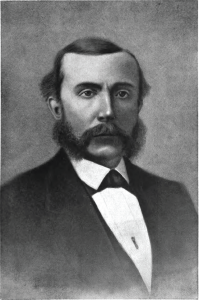

Note that these are all technology companies, where the low marginal cost of production makes it easier to scoop the entire market. But it also makes it easy for customers to be attracted to a brand new service, very quickly. That’s why Andy Grove (pictured below), the former CEO of Intel, a company that for a while dominated manufacturing of microchips for PCs, used the motto (and entitled his book) only the paranoid survive.

The paradox in this model of successful business creation is that success can bring the risk of regulation. Monopoly may be the result of outstanding innovation, excellent customer service and lowest price (e.g. Amazon’s current systematic destruction of pricing power by publishers by forcing them to accept lower prices, passed on to the customer). But once a company has that position it may abuse it (as some people fear Amazon will). Monopolists historically have been bad for service, price and innovation. Microsoft has produced some truly dreadful operating systems and got away with it for years, until the smartphone revolution gave them a real competitive threat. In 1880 Standard Oil achieved a de facto monopoly position in the US oil business, controlling 88% of the refined oil flows in the US. Founder and Chairman John D. Rockefeller (pictured below) used aggressive tactics to build this position, practices which in 1904 were found by the federal Commissioner of Corporations to be unfair.

When monopolists appear to be abusing their position, politicians start calling for regulation or the break up of the company (as happened with Standard Oil in 1911 and nearly happened with Microsoft). Google’s dominance may yet cause it to be more regulated, though calls for action over Google are as much about the sensitive nature of its business as its market dominance. The rapid consolidation of the US cable/telecom industry is triggering calls for regulation to prevent market power from blocking competition in the supply of web-based services such as Netflix.

The optimistic view of capitalist dynamics is that even dominant companies will eventually succumb to upstarts that will replace them or at least curb their ability to abuse their monopoly position, so don’t regulate, just leave it to the market. That took thirty years for Microsoft so we may have to be patient. The pessimistic view is that Theil is correct about the incentive for companies to strive for monopoly positions but we need a vigilant anti-trust or competition authority to intervene if those monopolies start to look too durable and damaging to the public interest. Each view has its merits and knowing when to intervene and when to leave the market to solve the problem is a very difficult judgement. We will never know if the break up of Microsoft twenty years ago would have been beneficial to customers. We do know that the high prices and lousy product quality motivated competitors such as Apple to offer an alternative and made customers highly receptive to non-Microsoft options when the smartphone revolution happened. So bad behaviour by monopolists can to some extent generate a self-regulating market response. Eventually.

(*) There are two types of inefficiency: i) monopolists are not forced to be cost efficient, so they produce at a higher cost than they should; and ii) they set price above the marginal cost that reflects the true scarcity value of the resources used to create the product (“allocative inefficiency”). It’s possible that a monopolist can avoid the first type of efficiency but it will always rationally charge a price above marginal cost, so that’s the real reason economics textbooks teach that monopoly is a bad thing.

Leave a Reply