The International Monetary Fund (IMF) is the one organisation that has come out of the financial crisis of 2007-09 in better shape than it went in. Set up to police the system of fixed exchange rates that was the basis of the Bretton Woods international financial system in 1944, the IMF should in theory have been put out of business when that system collapsed in the early 1970s and exchange rates of the major economies became floating. Instead it mutated into an agency for policing highly indebted or fiscally challenged countries, mostly what were then called less developed countries (LDCs) but also one or two rich ones, such as the UK in 1976. It became increasingly irrelevant in the world wide credit boom of the early 2000s because private funds were available to all but the poorest countries (which are funded by the IMF’s sister institution the World Bank). In 2006 the IMF was demoralised and shrinking. But it is now back in business. It has hugely expanded its financial resources, is hiring enthusiastically and is the essential institution at the conference table when debts are a problem, as they are in very many countries.

First age: Bretton Woods 1944-1973

It seems quite clear that if the IMF didn’t exist in 2006, nobody would have thought of inventing it. The original role of the Fund, as it is known, was to help countries that were in macroeconomic difficulty and which were in danger of abandoning their fixed exchange rate. The straitjacket of a fixed rate was a price thought worth paying for the stability it brought to international prices and trade. A country in difficulty could get advice from the Fund and temporary financing, usually no more than three years, which gave it a breathing space in which to put its economy on a sustainable basis. Typically that involved cutting public spending and reducing the growth of bank lending, since the usual problem was an overheating economy that therefore suffered a trade deficit which put downward pressure on its exchange rate. In cases of fundamental disequilibrium a country could devalue or more rarely (eg Germany) revalue. The Fund’s view on the “fundamental” nature of the condition was influential, if not decisive in allowing these exchange rate changes.

Second age: the Washington Consensus 1973-1998

With the ending of Bretton Woods, when the US stopped convertability of the dollar into gold in 1971 and the major economies gave up trying to fix their exchange rates, the Fund has no obvious purpose. Remarkably, it adapted to a world based on a diametrically opposite financial system. Now, flexible exchange rates were argued to be good because they allowed market forces to rule. They allowed countries to pursue independent monetary policies (impossible with fixed rates) and at the time there was optimism that this would lead to better macroeconomic outcomes, from theory (Milton Friedman in particular) and practice (the German Bundesbank’s highly successful policy was thought of as monetarist, though not everyone agreed with this description). The first half of the seventies saw massive inflation and economic instability on the back of the US budget deficits, a dramatic increase in global oil prices and the reaction to the ending of the Bretton Woods system. The second half saw the beginning of the taming of inflation through tough monetary and fiscal policies. But the high interest rates arising from these polices triggered the debt crisis that afflicted many middle and low income countries but chiefly Mexico, Brazil and Argentina, which all defaulted in 1982. The resolution of that debt crisis took the rest of the decade but it lay the ground for a new set of policy principles to which the IMF was an influential signatory.

The Washington Consensus was so-called because it was shared by the IMF, World Bank and US government (including the Federal Reserve). Their view was that all economies should aim for a liberalised, free market economy and financial sector. All countries should strive for free trade (a view that has a fair amount of academic and historic support) and free capital movements (which enjoys very little of either). Countries which got into financial trouble and needed Fund bailout money (though it wasn’t called that in those days) found that the price of support was a set of “structural adjustment” policies, the theme of which was more market forces. While privatisation, ending of distorting subsidies and cutting barriers to trade had a good chance of improving economic efficiency, there was much less reason to think that liberalising capital movements would be beneficial. But the Washington Consensus was dominant, because these three organisations controlled the money at a time when private capital supply was very limited.

The IMF, originally set up for the richer economies, found itself increasingly a hate figure for emerging economies. This was partly a useful role, to allow governments to pass necessary but unpopular reforms by blaming the IMF. But the apparent lack of sensitivity to social conditions, the close tie of the Fund to American foreign policy and the Fund’s association with some nasty regimes created a very critical image for the Fund. The IMF was widely criticised as being part of the US’s fighting of the Cold War and of promoting a western ideology at the expense of what was objectively needed for economic development.

Third age: irrelevance 1998-2007

The Washington Consensus, much criticised by both academic economists and by the countries forced to submit to it, died a death with the Asian financial crisis in 1997. Opening up their economies to the free movement of international capital made economies like Indonesia, Malaysia and Thailand boom for a while but the cost was that the reversal of those inflows was sudden, sharp and massively destabilising. The lack of firm intellectual foundations to that policy was acknowledged gradually over the next few years as the IMF conceded, in effect, that it had been somewhat arrogant and needed to approach countries in a more individual and pragmatic way. While this soul searching was going, the boom in global credit made the IMF increasingly unnecessary for many countries, which were able to attract private capital. Other countries swore they would never put themselves at risk of the Asian crisis, nor the humiliation of having IMF economists dictate to them. So as their economies recovered, pretty quickly but from a steep fall in output, the east Asian economies built up large reserves of foreign exchange as protection against any future sudden loss of access to foreign finance. They, in effect, self-insured in a way that made the IMF irrelevant to them. The IMF seemed to have no role in a world where countries were minding their own finances, international financial flows were almost entirely unregulated, and the dominant macroeconomic relationship was between the US and China, neither of which would ever take lessons from the IMF. The IMF cut its headcount in the mid-2000s, and faced increasing difficulty in hiring staff against the much higher salaries on Wall Street. Morale was low and the institution lost the political importance it had during the Consensus days.

Fourth age: trusted advisor 2008- present

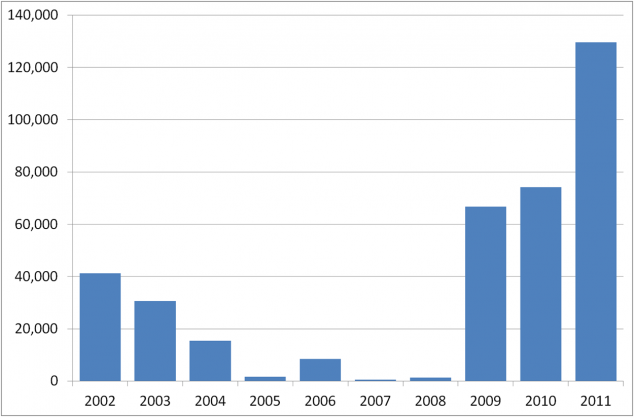

The international financial crisis gave an unexpected boost to the IMF. First, several countries suddenly needed emergency funding because their ability to tap private capital markets had vanished and they faced severe macroeconomic adjustments. The Fund was the only source of funding and rapidly needed a large increase in its resources. The IMF has seen an explosion of lending. This chart shows the amounts committed in various types of loans in billions of Special Drawing Rights (One SDRs = US$1.52 and €1.21 at August 29th 2012).

Source: IMF Annual Report 2011, appendix II.1Second, the Euro crisis required a credible and independent third party with competence in macroeconomic affairs and public debt. The local players – the European Central Bank and the European Commission – lacked one or more of these qualities. The IMF correctly lent its expertise to the design of the Greek, Portuguese and Irish bail outs. More controversially it lent its money. Since the Eurozone as a whole is the world’s second largest economy and has no aggregate debt problem, it is hard to see why the IMF should put its shareholders money at risk. The fact that the Managing Director (ie the head) of the IMF has traditionally always been a European has made non-Europeans suspect bias in the volume and relatively soft terms of the lending. It does appear that Dominique Strauss-Kahn, the MD from 2007-2011 and at the time seeking to be a candidate for the Presidency of France, involved the IMF more than was perhaps wise. His successor Christine Lagarde, herself formerly a French cabinet minister, has kept the IMF at a slightly greater distance from the Euro mess than many feared. But the IMF is still on the hook for up to $28 billion to Greece, though not all of this has yet been disbursed. Always the most senior creditor, the IMF may be the only institution that really will get its money back from Greece, but it’s equally likely that much of this money will not be repaid.

Fifth age: future global central bank?

Bretton Woods was a deliberately designed international financial system which worked pretty well for nearly thirty years. Global growth was high, the war-wrecked economies of Germany and Japan recovered spectacularly and several newly industrialised economies saw a transformation of living standards (South Korea, Hong Kong, Singapore, Taiwan). Since the end of that system there have been ideologies and financial facts on the ground but no actual system. Many would like to see a new system which accommodated the dramatically changed economy of the twenty first century and provided stability and confidence out of which continued global growth could proceed.

The governor of the People’s Bank of China, Zhou Xiaochuan, suggested in 2009 that the IMF’s quasi-currency, the SDR, might form the basis of a new global reserve currency. This was a constructive proposal but one with little chance of success. Just as the US was very clear that the IMF should not have sovereignty over American financial policy, it is hard to imagine a Chinese government submitting to a superior global central bank, even one in which China had a large shareholding.

But the IMF is there and if there is to be any progress towards a new financial architecture, the IMF will be at its centre. To be a true central bank, the IMF would need hugely increased financial resources, which is just about conceivable. But it would also need power. Domestic central banks must be independent of the government and the same would be true of a global central bank. That would create a new centre of power in the world that is hard to envisage at present.

But we should be grateful that the IMF has survived its former periods of discredit and irrelevance. It combines many highly intelligent, dedicated and committed experts who are relatively free from political interference. That is something of value as we navigate the global financial storms of the future.

Further reading

The leading international macroeconomist Maurice Obstfeld writes about the future of the SDR here. The IMF has a wealth of excellent reports, factsheets and data on its website. Some of the individual factsheets are used in the MFin Financial Institutions and Products course. One example is their admirably clear description of the function of banks. For people curious about the arcane matter of IMF quotas, here is a recent discussion of the matter.

I should declare a personal interest in that several friends and former student colleagues of mine are senior employees at the Fund and I discussed these matters with them recently in Washington DC. The views are of course mine, not theirs.

Leave a Reply