The high and rising level of Chinese corporate and local government debt has been a concern for several years. Recent data from the People’s Bank of China suggests the true figure may be much higher than we thought, but things are far from clear.

*

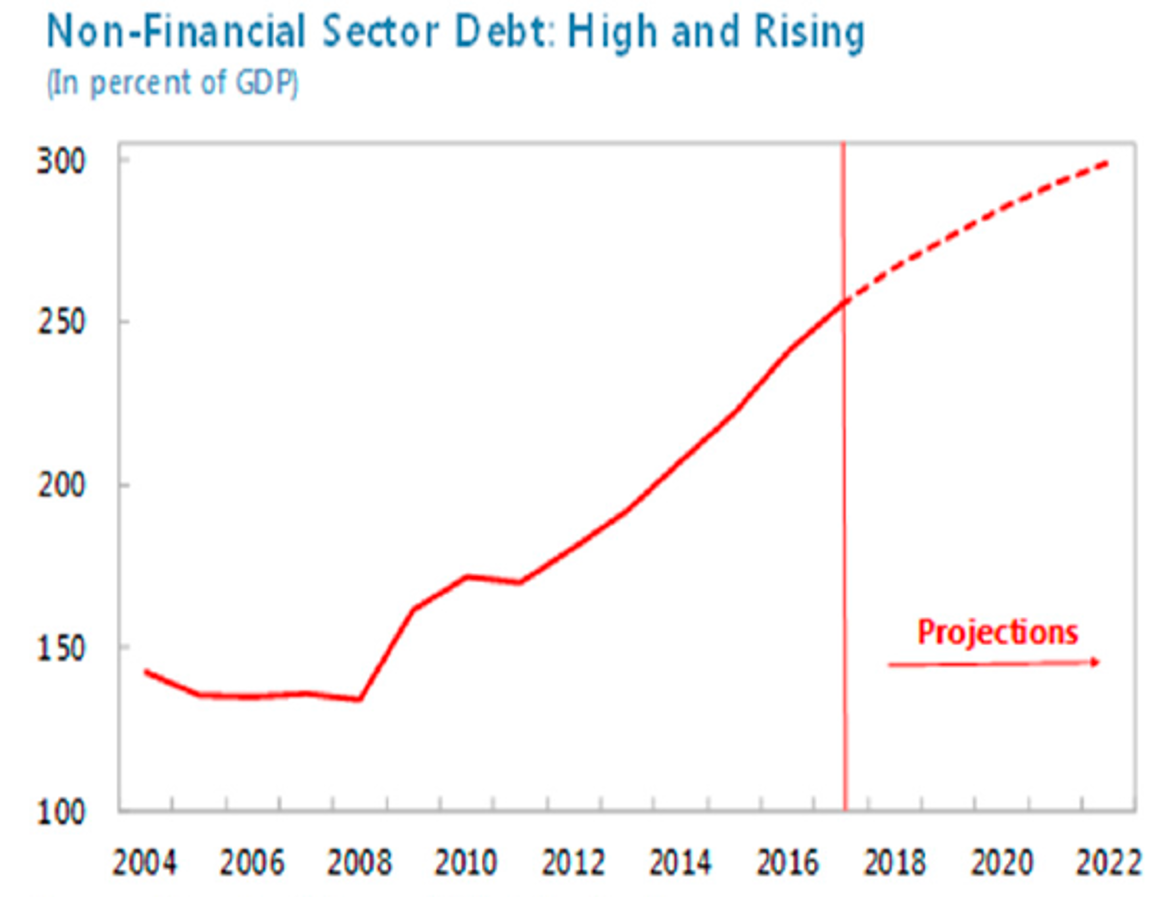

It is conventional wisdom that China’s corporate debt is too high for comfort and if it continues to rise could pose a risk to financial stability. The IMF, in it’s annual Article IV report on China in August 2017, diplomatically stated that “China has the potential to sustain strong growth over the medium term. But to do this safely requires accelerating reforms to rebalance towards less credit-intensive

growth..” The accompanying chart is a bit more alarming:

The debt is mostly lent by banks, which are almost all state-owned (or owned by cities and provinces). And the debt is concentrated in the state owned enterprise (SOE) sector. In other words, the debt is all within the public sector, which for optimists provides some comfort as it means any future bailout could be relatively straightforward. The Chinese government could recapitalise the banks and the debt would, in effect, transfer to the state (sovereign) level. Since Chinese sovereign debt is not too high (37% of GDP at the end of 2016), the risk is manageable (*). The Chinese government bailed out the state banks 20 years ago, before they were privatised, so there is a precedent.

But there is a second form of debt which is potentially more problematic, off-balance sheet debt which is owed by companies to individuals (or possibly to other companies). This forms part of the shadow banking system, a term which means chains of financial borrowing and lending which have a similar economic substance to that of a commercial bank, namely long term lending backed by short term funding. This “maturity mismatch” is both useful (because long term loans would otherwise only be available if there were willing long term lenders, which are few in number) but it’s also dangerous, because a sudden withdrawal of the short term funding cannot be met by reversing the long term lending. Banks routinely run this mismatch but they are supposed to be prudent about it and, just in case they aren’t, they are regulated. Shadow banking creates a similar mismatch but without regulation and without the backup of the central bank to help smooth over any short term liquidity problems.

Shadow banking grew in China because, until recently, the People’s Bank of China (PBOC – the central bank), regulated interest rates, setting limits on both lending and deposit rates, along with quotas for specific types of lending. These restrictions have now more or less gone but their existence led to an informal market in which borrowers willing to pay more than the regulated rate were matched with lenders happy to receive a higher rate than what they received on their bank deposits. There are various ways that this can take place but the easiest one to explain is the so-called wealth management products (WMPs). A WMP is a bundle of loans wrapped up in a form of security, which is sold to individuals (or companies). Although typically sold by or through banks, the bank acts only as agent, and in theory has no responsibility for the product if the loans go sour. The product is typically for one year and offers a much higher interest rate than available on the bank’s own deposits.

The retail buyer of such products could be forgiven for thinking that the product is backed by the bank and so there is some guarantee that the bank guarantees it, though there is nothing to officially say so. Anyone with the slightest awareness of finance – or even some common sense – might suspect that higher returns must be associated with higher risk, which is normally the case. And these WMPs are often providing loans to high risk companies, including property developers. But the retail investor can safely ignore the risk if they think it rests with the bank selling the product. So we have a potentially serious problem of what the IMF calls implicit guarantees.

On top of the informal lending to the corporate sector there has been a thriving flow of lending to the provincial and state governments, which use off-balance sheet “Local Government Financing Vehicles” to get round central government restrictions on their spending. This IMF report analyses Chinese LGFVs.

These problem and its rough scale have been know for several years. A recent report for the Berlin-based Mercator Institute for China Studies by Professor Victor Shih of University of California at San Diego estimates total non-financial debt outstanding in China at May 2017 as 254 trillion yuan, or 328% of 2016 nominal GDP. Is that a number to worry about? Well total debt to GDP for the US in 2016 was 252%. Economics is good at telling us that a trend is unsustainable but not very helpful at telling us when that trend will stop or reverse (which often takes place in a crisis). It is widely agreed that China’s debt is high and that if it keeps rising at the current rate (Prof Shih says the debt increased by 26% from the end of 2015 to May 2017, much faster than GDP) then financial stability and growth are in jeopardy. Shih doesn’t expect a financial crisis in the next five years but sees other risks, including a flight of capital putting downward pressure on the yuan exchange rate.

A shock new figure for off-balance sheet debt from the PBOC

The PBOC has been trying to control the shadow banking sector in China, which in recent years has accounted for most of the growth in total credit (what the PBOC calls total social financing). But the latest PBOC Financial Stability Review almost casually seems to say that there is a great deal more shadow debt than previously acknowledged. This fact and a lot of excellent analysis are contained in the anonymous Deep Throat (**) blog published on 2 October 2017.

The PBOC estimated that off-balance sheet bank loans were 253.5 trillion yuan at the end of 2016 (about $36 trillion). This is slightly greater than the banks’ balance sheets, and as the PBOC drily notes, “embedded risks remain”. What Deep Throat noticed is that this figure is far higher than previous ones and that the PBOC restated the 2015 number by more than 100%. Previously the off-balance sheet loans were estimated to be only around 40% of the balance sheet, still pretty big but much less than the new figures.

Deep Throat goes on to make educated guesses about what is going on and to re-estimate China’s debt to GDP based on “productive GDP”, subtracting some of the infrastructure investment that has contributed to GDP growth but may have little or no economic return. The result is estimates of debt to GDP above 800%.

Christopher Balding, an American professor at Peking University’s HSBC Business School in Shenzhen, also tries to make sense of the figures in his blog. He emphasises that if this is really newly discovered (or recognised) debt then we are really in the dark as to what is going on in the Chinese financial system and that is deeply worrying. He analyses the possibility that it is somehow double counted debt but concludes that this isn’t much comfort because it would still imply a much higher level of de facto bank leverage than previously thought.

He also suggests a sort of conspiracy theory to explain the new PBOC disclosure. The greatly respected PBOC governor Zhou Xiaochuan is expected to retire soon (there is currently a lot of speculation as to his successor). An important member of the pro-reform group in the Chinese government, Governor Zhou might be taking the opportunity to ring a few alarm bells inside an otherwise complacent government, to make sure that the problem is dealt with, rather than allowed to get even worse. Governor Zhou recently made a speech expressing worry about China facing a “Minsky moment“, a term named after the US economist Hyman Minsky who analysed the psychology of debt dynamics that lead to financial crises. A Minsky moment is when the system realised that there is too much debt and that some of it will not be repaid, leading to panic selling of assets. Governor Zhou’s remarks were followed by a drop in the Chinese stockmarkets, as one might expect. Perhaps, suggests Balding, he is using his final period in office to sound the alarm.

The IMF is working on its own Financial Sector Assessment Programme for China, due after November 2017, which should shed some more light on this matter.

(*) (The IMF argues that the correct measure of government debt, which includes local government debt, is closer to 90%, a definition that the Chinese authorities dispute).

(**) Deep throat was the codename for the anonymous source, later revealed to be the associate director of the FBI, who gave crucial information in 1972 to two Washington Post reporters who eventually uncovered the Watergate scandal that led to the resignation of President Richard Nixon in 1974. It is now used to refer to any anonymous source or whistleblower. The original name came from a US pornographic film which according to Wikipedia was “at the forefront of the Golden Age of Porn”.

Sinoquest

A somewhat naïve question perhaps, but given that debt jubilees have been a common occurence throughout history, wouldn’t China be able to pull one off given that most of its lending is within-the-system? Maybe not do it 100% cleanly but still be able to absolve parts of the system.

Simon Taylor

The idea of a debt jubilee goes back to the Old Testament so it doesn’t have much resonance in Asia. I believe it wasn’t actually practiced but the idea has been used to motivate the write off of unfair or “odious” debt. The debt in China doesn’t really fall into that category and most of it is in the public sector, which makes a resolution a lot easier than when there are private conflicts between debtors and creditors. So it’s an interesting idea but unlikely and probably not necessary.

Bismark Oppong Asumang

Great insights on this one professor.

I’m just curious, apart from a likely bailout by the Chinese government, what other measures could be put in place to curtail the problem of “shadow banking”. I am concerned that if the government should bailout like it did some twenty year ago, it might become a regular practice which means the financial sector may be motivated to be reckless.

Simon Taylor

Bailouts always risk creating moral hazard risk, it’s true.