China’s corporate debt is high and rising fast. Most of it is in the state owned enterprise sector and is borrowed from state owned banks. So the debt problem and the responsibility for fixing it lies with the government.

*

Despite GDP growth that is still one of the highest in the world, China’s economic outlook and stability are increasingly at risk from excessive corporate debt. The debt is concentrated in the state owned enterprise (SOE) sector, especially in real estate and in the basic industries such as steel and mining, where there is a lot of excess capacity.

In its annual Article IV mission report on China, the IMF this August summarised the situation:

“The near-term growth outlook has improved due to recent policy support. But the medium-term outlook is clouded by continued resource misallocation, high and rising corporate debt, structural excess capacity, and the increasingly large, opaque, and interconnected financial sector. The apparent challenges in implementing a clear and decisive reform path add to concerns that China may exhaust its still-sizable buffers before the economy changes course sufficiently.”

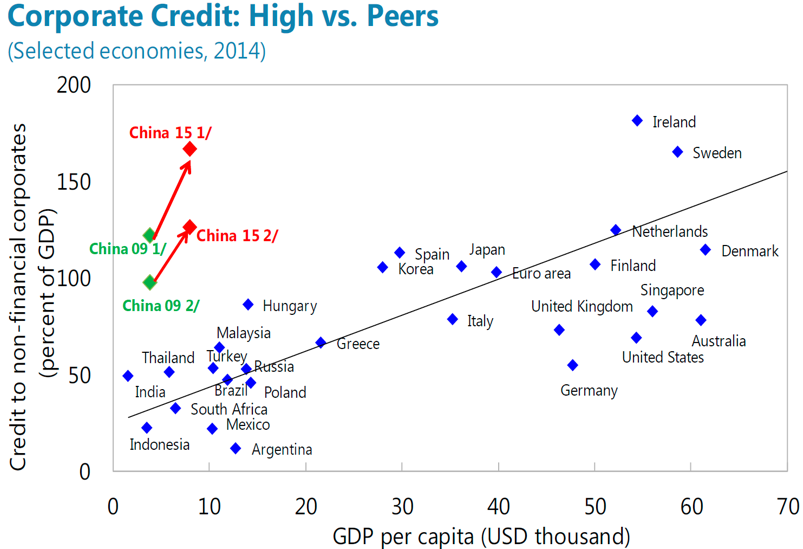

This is reasonably strong stuff from the IMF, which tries to be diplomatic about its member states. Some charts explain the IMF’s concern. The first chart shows corporate credit by country, with China high and rapidly rising, given its level of GDP per head.

Most credit booms end in a bust

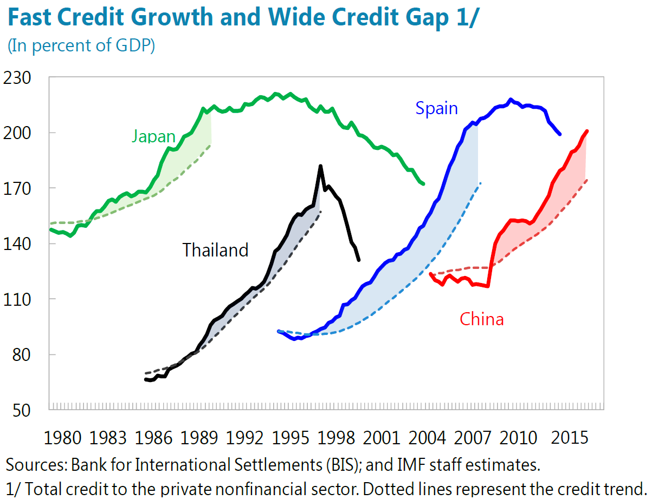

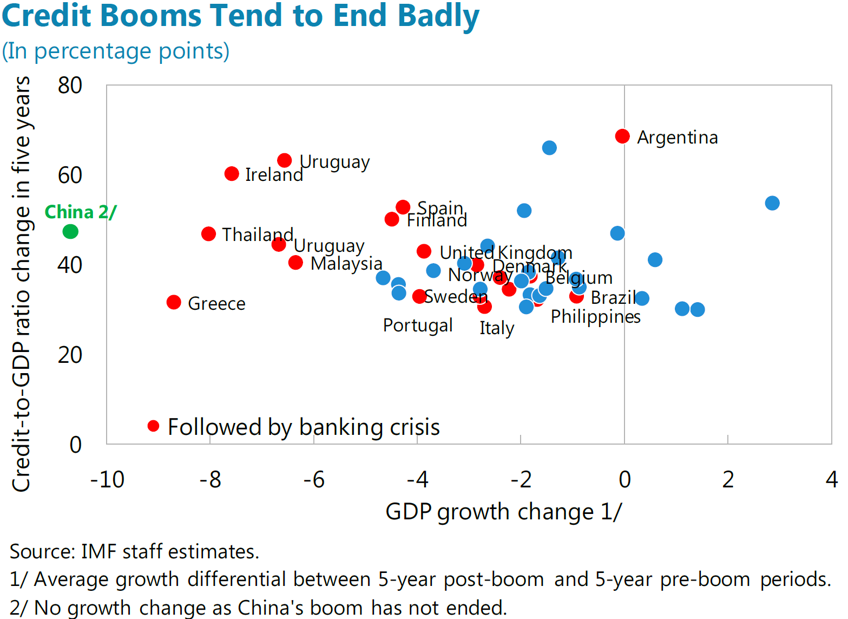

The IMF also shows some historic context. (see chart below). Other countries have seen rapid credit growth on the scale of China and it has not ended well. Japan, Thailand and Spain all had fast credit growth followed by a crisis and fall in credit. China is on an alarmingly similar path, though that doesn’t prove that it will also have a crisis.

The problem arises in large part from the growth of lending to SOEs, both those owned by the central government and those owned by provincial governments. The pressure on provincial governments to grow GDP and to avoid restructuring over-capacity industries makes ever higher borrowing very appealing. But the problem is that these SOEs cannot service the debt because they aren’t profitable enough.

The IMF reports that centrally owned SOEs have a return on assets of about 3% and locally owned less than 2%),compared with the private sector average of around 6%. Average leverage in the private sector is 100% but 170% for SOEs it is. And these averages conceal extremes, including structurally loss-making SOEs, unable even to service their interest payments out of cashflow.

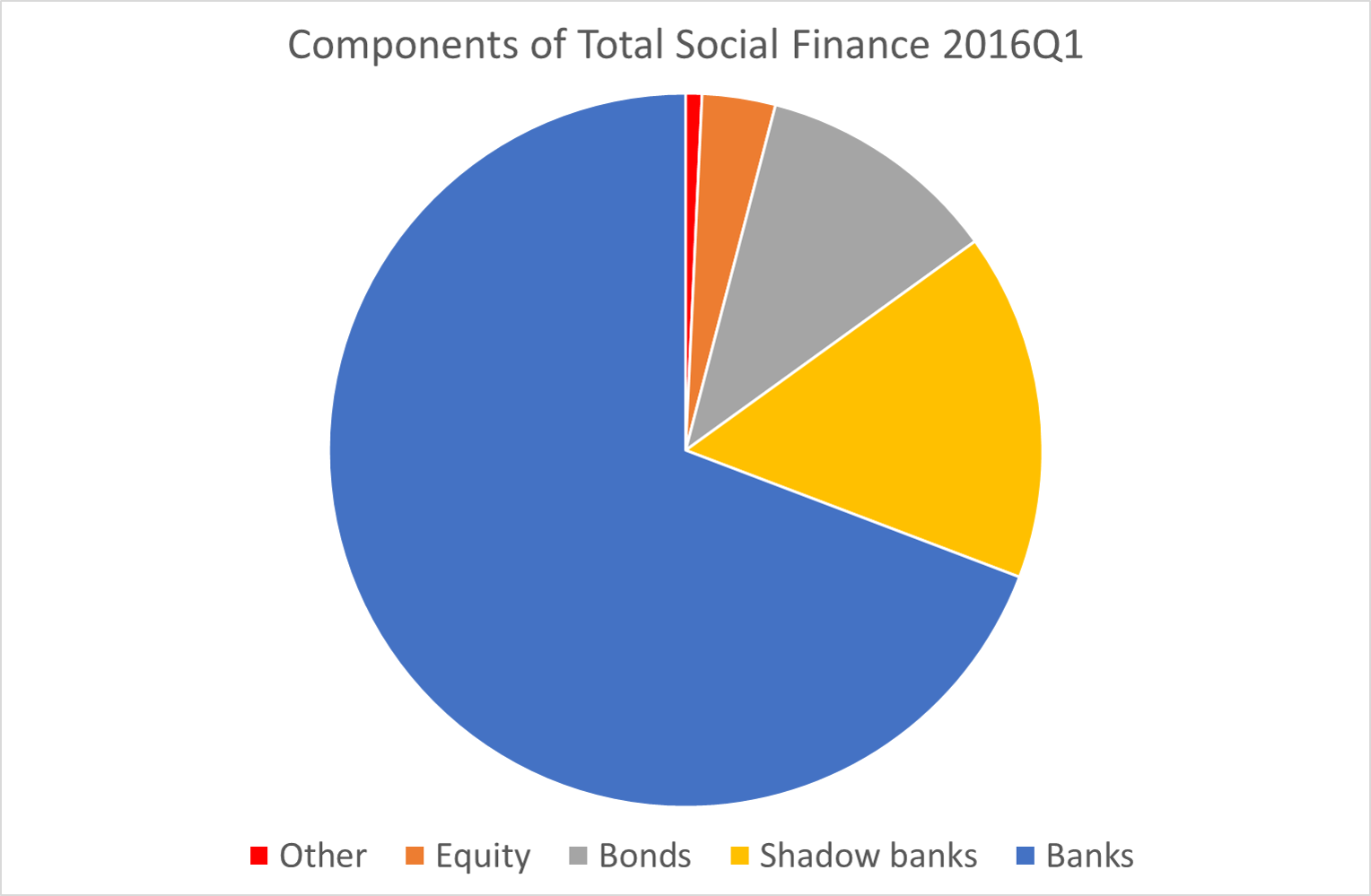

The problem debt was mainly lent by banks, the great majority of which are also either centrally or locally state owned. But growth of credit from non-financial institutions has also been fast (“shadow banking”). The chart below shows the components of what the People’s Bank of China calls “total social financing”, an aggregate measure of funding.

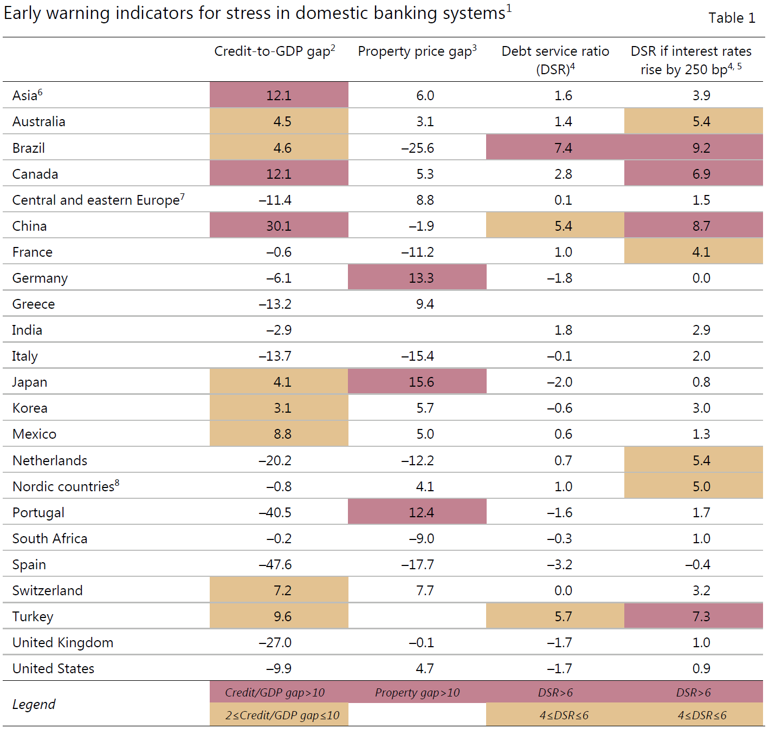

The rapid growth of debt, to levels that are high by comparison with other countries with similar levels of national income per head to China, makes investors and regulators increasingly worried. The Bank for International Settlements, the central banks’ bank, sees China as increasingly flashing red in its map of early warning indicators of banking stress (see below, from the BIS quarterly review of September 2016).

The problem ultimately rests with the government

Some investors are relaxed about the debt, precisely because it’s in the state sector. They reason that if the SOEs default, they will be bailed out by the banks (which are also SOEs). But if that means the banks themselves get into trouble, then the government will bail them out. This has happened before, when the entire Chinese banking system was recapitalised by the state in the 1990s after it had made huge losses and was, in effect, insolvent.

But this means that the debt would eventually show up as a problem for the central government. Currently the IMF estimates the Chinese sovereign debt as about 60% including contingent debt and other “unofficial” debt (the official figure is nearer 40%). But the figure could rise by at least 10% and maybe a lot more if the government has to rebuild the banking system again. Debt can’t just be wished away – somebody must take the cost when it is recognised as not being repayable.

The final chart shows that it’s not just the level but the speed of change in debt which is worrisome. Most countries that had fast credit-to-GDP growth eventually had a fall in GDP, typicallyresulting from the reversal of the lending as an injured banking system took time to rebuild its reserves. China hasn’t yet seen the end of the credit boom and may yet avoid a crisis but it is firmly in the danger zone.

Conclusion

China’s debt is domestic, not foreign, meaning that resolving it is an internal matter, unlike say the Greek debt problem. But that doesn’t mean the rest of the world can relax. If current GDP growth is only being achieved by an unsustainable growth of credit, then eventually it must stop. Economics isn’t good at predicting exactly when credit booms will end but it tells us that they always do eventually, and usually abruptly, with a sudden shock to the economy.

The Chinese government faces an unpleasant dilemma. If it keeps the unprofitable SOEs going, the debt level will become increasingly unmanageable, and it will be more likely to end in a crisis. But dealing with the debt means shutting down a lot of surplus capacity and forcing companies into bankruptcy, with a large increase in unemployment, especially in the northeast of China (increasingly referred to as the “rust belt”, a term invented to describe the US states and cities which had suffered from closing industries, often caused by competition from China).

The official policy of restructuring the state enterprise sector appears to have all but been abandoned in the face of vested interests and the short term political costs of unemployment. But that suggests a continued growth of credit and an even bigger crisis – which would hit the world economy – in future.

FURTHER READING

IMF Working Paper October 2016: Resolving China’s Corporate Debt Problem

IMF Article IV China report 2016

Bank for International Settlements Quarterly Review September 2016

Michael Pettis’ blog has argued persuasively for some time that China’s GDP growth will slow to 3-4% without the temporary and unsustainable support of credit growth

The Institute for New Economic Thinking (INET) explores the wider growth of private sector debt and how the Chinese debt problem matters for the whole world economy

More on the rebalancing of the Chinese economy here and on the importance of the private sector for China’s future growth here.

rjw

The thing that has particularly caught my eye in recent weeks is the continued slowdown in private investment, and the sharp spike in state-led investment. While aggregate fixed asset investment has kept steady, the components are diverging sharply (there is a nice chart in the Article IV figure 1 on page 33).

Until recently, I think the China optimists could have pointed to the fairly steady aggregate growth rate, growing contribution to growth from consumption and rapid services growth as signs of underlying restructuring. The prospect of a smooth adjustment remained somewhat plausible. If private investment is also sinking, this rosy scenario looks much less plausible.

My reading is that they will pull out all the stops in the short run to keep growth up – hoping to muddle through, or grow their way out of the problem, as in the post 2000 banking clean-up. I think though that this time the scale of the problem is much bigger and this option is not going to work.