It is widely agreed, including by the Chinese government, that the Chinese economy needs to be rebalanced if economic growth is to continue in the long term, without severe tensions or a full blown crisis. The heart of the problem is that the very high growth of GDP in recent decades has been based on excessive investment (see this blog), and too little consumption. This has been achieved through a distorted banking system in which interest rates have been controlled in order to subsidise investment by the state owned enterprises, a de facto transfer of resources from household consumption to state-driven investment.

Nicholas Borst, a China economics expert at the Peterson Institute for International Economics, keeps a very useful measure of China’s progress on economic balancing. Unfortunately his latest quarterly update gives the country an F grade for rebalancing.

He has five quantitative criteria:

1. Urban disposable income growing faster than GDP.

2. Positive real interest rates on deposits.

3. Residential real estate investment growing at a slower pace than GDP.

4. Loans to smaller enterprises growing faster than total enterprise loans.

5. Growth of the tertiary sector [services] faster than the secondary sector [manufacturing].

Taken together, these indicators capture whether the economy is i) rebalancing the mechanism of resource allocation (bank interest rates and loans to small businesses instead of large state owned enterprises); and ii) seeing a resource shift from investment to consumption, especially away from the real estate sector.

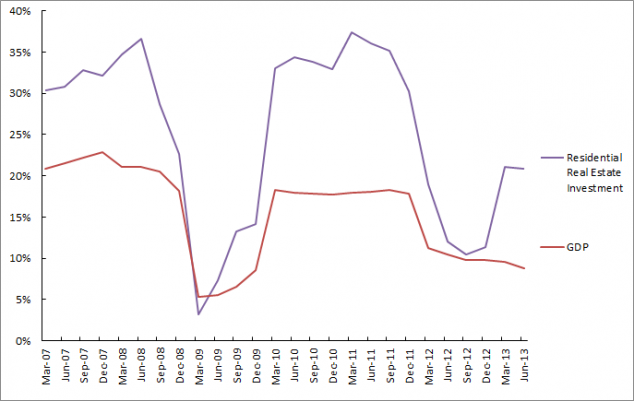

In previous quarters there was some progress on these or at least a few of them. But the latest data paints what Borst calls a “depressing picture” of rebalancing, the worst quarter in some time. The most discouraging indicator is the growth of residential real estate (see chart below), which was ten percentage points ahead of GDP growth in the second quarter of 2013.

The re-acceleration of real estate investment has come despite official policy attempts to slow it down, not least through tighter credit control. But the growth of shadow banking in China (institutions which bring about financial intermediation like banks but not regulated as banks) and the associated surge in unofficial and unregulated lending has frustrated the People’s Bank of China in its attempts to shift the pattern of investment.

Leave a Reply