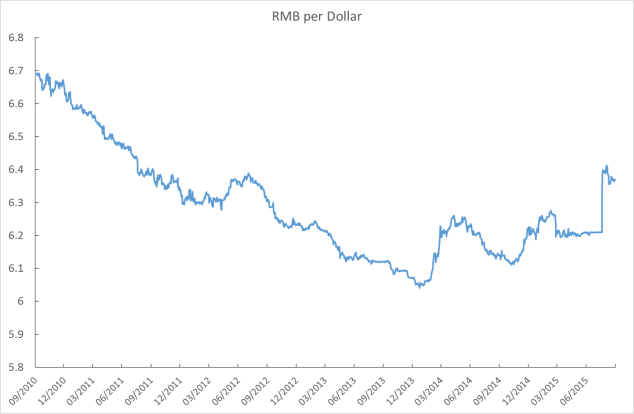

For years there has been pressure on China to allow its exchange rate to be determined by market forces rather than by the central bank. Now that seems closer to happening but it might mean a fall in the RMB, which is not what most of China’s critics wanted.

*

For years, China held down its exchange rate against the dollar to boost its export competitiveness. That was part of its strategy for boosting economic growth and rapid increases in manufacturing employment. The country’s persistent current account balance of payments surplus suggested that the exchange rate was undervalued. And the enormous increase in the country’s foreign exchange reserves was evidence that the central bank was intervening in the market to prevent the RMB from rising. This distortion of market forces was controversial, especially in the US, where politicians and some respectable economists argued that the policy cost the US jobs, thought it also allowed the US to buy Chinese goods more cheaply, so there were winners and losers.

The People’s Bank of China (PBOC – China’s central bank) has progressively allowed market forces to have a greater role in setting the RMB/dollar rate in recent years, though it is what economists call a “dirty float” rather than clean float, because of continued intervention. The RMB rose during 2014, and in May 2015 the IMF, the nearest thing to a global referee on exchange rate matters, declared that the RMB was no longer undervalued. It noted that the continuing but lower current account surplus was evidence of imbalances elsewhere in the economy (savings remaining too high), rather than an undervalued exchange rate. But it noted that China could now move towards a genuinely floating rate in 2-3 years with intervention “limited to avoiding disorderly market conditions or excessive volatility”.

In August 2015 the RMB fell about 3% against the dollar, in a move that was seen both as an attempt to move to cleaner floating (partly to help get the RMB included in the IMF’s SDR currency basket) and as a way of boosting China’s competitiveness to stimulate an economy that is widely seen as slowing down too quickly. But 3% is too small to have much impact on trade, so the move was probably more about the SDR. (There is also, according to Christopher Balding’s blog, a theory doing the rounds that it was intended as a message to the Federal Reserve to go slowly on interest rate rises, or the PBOC might let the RMB fall much further. I don’t know how seriously to take this, there are lots of conspiracy theories in China, especially with respect to the US).

The latest data on China’s foreign exchange reserves showed them falling in August 2015 by $94 billion to $3.56 trillion, down from a peak in 2014 of just under $4 trillion. China’s current account remains in surplus at about 2% of GDP (down from over 10% at the peak in 2007). So what’s happening?

Recall that the overall balance of payments is the sum of the current account (mainly exports, imports, interest and dividend payments) and the capital account, which can be divided into three: i) foreign direct investment (US firms investing in China, Chinese firms investing in the US etc); ii) other private sector financial flows; and iii) intervention by the central bank. (A previous blog discusses China’s balance of payments in more detail). The other financial flows are supposed to be limited into and out of China by exchange controls which prevent foreign investors from buying more than a set quota of Chinese domestic financial assets and limit outflows from Chinese residents to another set quota. Gradually these quotas have been increasing in recent years.

Foreign direct investment is relatively steady and has been a major source of flows into China in the last 20 years, as foreign companies acquired businesses in China or made greenfield investments. Far less FDI has flown out of China, though that is likely to increase considerably in future.

The total demand and supply for RMB versus the dollar must balance. Any imbalance will lead to a fall or rise in the exchange rate, which is a cleanly floating rate. If the PBOC wants to change the rate it can buy or sell dollars, thus ensuring that demand and supply balance at a different rate from what the market would have set.

The pattern for years was that China had a large surplus on its current account, plus a large surplus on FDI. The other financial flows were very small, because they were restricted. This meant overall a surplus of demand for RMB compared with demand for dollars and would have pushed up the value of the RMB. The PBOC didn’t want that, so it bought dollars (by selling RMB) and kept the RMB rate down. It thereby acquired lots of dollars, which is where the $4 trillion of foreign reserves came from.

Now China still has a current account surplus and a surplus on FDI (though smaller than before). If the reserves are now falling it means the PBOC is selling dollars to buy RMB. We can infer that the “other financial flows” are negative i.e. funds are leaving China. The PBOC, far from keeping the RMB rate down, as it did for years, is now propping it up.

Yet if the IMF is right that the RMB rate is about the right level relative to economic fundamentals, shouldn’t the PBOC just let the market take the decisions? The problem is that the capital leaving China is on a large and potentially alarming scale. Estimates of the capital “flight” are in the range of $100 billion a month. These funds represent Chinese individuals and companies taking money out of the country to buy assets abroad. It seems the exchange controls are considerably less robust than they used to be, or perhaps people have become cleverer at finding ways round them. On a recent trip to China I heard of companies buying up individuals’ unused quotas to buy foreign exchange as a way to take large amounts of funds abroad. This is illegal but hard to police. Once a central bank starts liberalising capital flows it’s hard to then reverse it. You can think of a large dam, which the authorities then start drilling holes in. Gradually water flows out and the holes get bigger and more numerous. Eventually the authorities can’t plug the illegal holes, which keep multiplying. Eventually the dam collapses and all the water surges out. That’s why liberalisation is so often followed by financial crises.

A strict policy of leaving it to the market would mean the PBOC just watching capital flight and letting the RMB fall. Nobody knows how far it would go but I’ve seen estimates of 10-30%. That would be quite a shock to the rest of the world financial system and would be highly controversial ahead of an American presidential election, in which candidates always find it convenient to blame China for any weakness in the US economy. A falling RMB means a rising dollar, which could choke off US growth, at a politically sensitive time.

If capital flight continues though, the PBOC would have to use more and more of its reserves to sell the dollars which Chinese residents are buying. Those reserves have already fallen by $400 billion. A remaining $3.6 trillion still sounds like a lot but it is widely thought that some of that figure is invested in illiquid assets such as real estate (the asset mix is a secret). So not all of the reserves can be mobilised at short notice and sold. And would China want to see its reserves rapidly fall?

At some point, if the capital flight continues, the PBOC will face the same dilemma that many emerging economies have faced over the years (and the UK in 1992): either risk seeing reserves exhausted or give in and accept a potentially sharp fall in the exchange rate. History suggests that when an exchange rate falls it often falls a lot, “overshooting” its fundamental level. If the IMF is right then the RMB is already at its fundamentally correct level. The capital flight would be distorting the exchange rate, not pushing it to its “correct” level. A market determined exchange rate would be damaging not helping the cause of economic and financial stability. But we also know from history that exchange rates can be volatile and can deviate for years from anything that looks like a plausible fundamental rate.

A sudden fall in the RMB might be the biggest shock to the world economy since the global financial crisis. This is not yet probable, but it would have seemed completely out of the question even six months ago, which shows how quickly things can change in financial markets. China doesn’t really need $4 trillion or even $3 trillion of reserves, the amount having risen by accident rather than by design (see this blog). But the combination of worries about how quickly the Chinese economy is decelerating and a sudden realisation that the RMB is vulnerable to weakness is unwelcome when the world economy is more fragile than we would want.

Leave a Reply