Sub-Saharan Africa (SSA) is abundantly endowed with natural resources, whose value has increased in recent decades. But this has not led to increased benefits for the majority of the people. A recent IMF working paper sheds more light on the challenge of making Africa’s wealth work for most Africans.

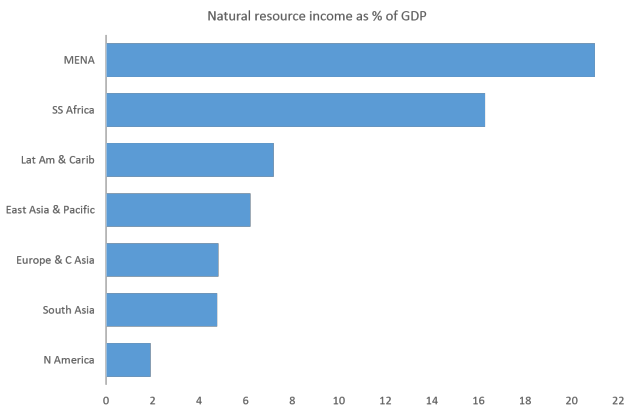

Ahead of the forthcoming annual Cambridge African Business Network conference on June 6, I’ve been looking at a recent IMF paper. SSA has the second largest regional natural resource income as a share of total GDP, behind the Middle East and North Africa (see chart below).

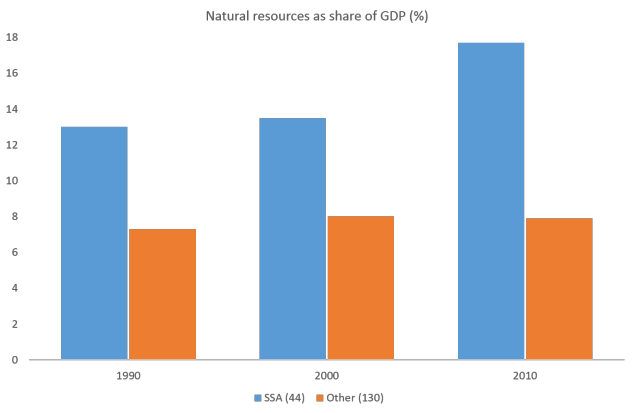

Moreover the share has been increasing relative to the rest of the world in the last few decades (see figure below).

The increase is partly a result of the commodity “super-cycle” increase in prices mainly driven by the growth of the Chinese economy. That cycle may now have come to an end or at least be moderating. SSA still has a great deal of resource wealth. But it hasn’t translated so far into better outcomes for Africans, as measured by the human development index (HDI) for example. The authors of the report conclude that: “despite the increase in natural resource revenue, economic growth and development in resource-rich SSA countries haven’t been better than other resource-poor countries.” Life expectancy has grown in resource-rich countries but it is still lower than resource-poor countries.

How can natural resource wealth fail to drive better GDP growth and economic prosperity? There are two linked reasons:

- the “resource curse”; an abundance of natural resources generates income but it can lead to a distorted economy in which other sectors, which are often more employment-intensive, are held back; one mechanism is a rise in the exchange rate which makes those other sectors uncompetitive; overall GDP therefore doesn’t rise as much as expected and the structure of the economy is moved away from mass employment to the generally capital-intensive resource sectors;

- poor governance; abundant resource revenues can distort and corrupt government and other institutions; a small elite can end up taking most of the benefits, leaving little for the rest of the people and a lack of investment in social and physical infrastructure; country corruption levels are highly correlated with the scale of natural resources.

For example Nigeria and Angola have benefited from major oil reserves but the two countries have higher than average inequality and worse human development scores than other SSA countries with fewer or no natural resources.

These effects have been observed frequently in resource-rich countries which therefore fail to grow and develop to their full potential. The report notes that Mauritious and the Seychelles, which are resource-poor economies, have shown better growth than many SSA countries, in part because they have stronger institutions. Countries with strong institutions, usually developed before the resources became important, also manage better with natural resources e.g. Canada, Australia and Chile.

The IMF researchers estimate that welfare (constructed from data on GDP, inequality and life expectancy) rose less in SSA from 1970 to 2007 than other regions of the world and was lower for resource-rich countries than resource-poor.

What happens when a country experiences a natural resource shock?

The report also estimates the effects of a positive resource “shock”, meaning that a country has a sudden rise in resource revenues, owing to a sharp rise in the value of its resources. It finds that:

- SSA countries are more exposed to such shocks than other countries;

- in the short and medium term these shocks do improve welfare and reduce inequality to some extent, but less so in SSA than in other countries; and

- in the longer term the effect tends to dissipate in SSA, leaving few of the benefits for the majority of the people.

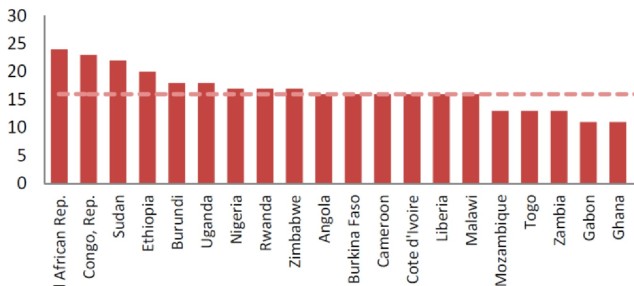

The effects are weakest for “fragile” states, where the benefits are smaller and more temporary. USAID (the US Agency for International Development) defines fragility thus: “The key difference between fragile states and states that are more capable is the nature of the relationship between the government and the governed. In fragile states, this relationship is poor. The government acts in ways that create conditions (or outcomes) that are broadly seen as ineffective, illegitimate, or both.” Fragility tends to be higher in war zones, areas of ethnic conflict and where there are regional disputes over control of natural resources. SSA has more than its fair share of fragile states. The following diagram shows data for some African countries, the score being calculated by the Center for Systemic Peace.

The IMF report repeats the finding from other research, namely the crucial role of the state and institutions in bringing about economic development and ensuring that GDP growth translates into good outcomes for most of the people. Unfortunately it doesn’t say much about how to do this, though in fairness a lot of research suggests that the roots of weak or failing institutions are historically very deep. For example a 2012 report by Stelios Michalopoulos and Elias Papaioannou documented “a strong association between pre-colonial ethnic political centralization and regional development” after controlling for geography. Those countries which previously had stronger political institutions, before colonialism, show better economic development today. (One innovation in this paper was to capture current economic development using satellite images of night time light, which is a pretty good proxy for economic development and more reliable than GDP data).

Conclusion

Africa’s future depends on a lot more than natural resources. A recent speaker to the MFin emphasised that it was some of the countries without oil that were the best places to invest. Africa has abundant human resources too. The continent starts with a lot of historical disadvantages, plus fragmentation (arguably too many countries). But there is evidence of improvement in governance and lower fragility. The Cambridge conference has been quite inspiring in the last few years and I expect this one to be so too.

Sean Seymour-Dowd

Having lived in parts of SSA, I agree with a lot of this, especially on the point of Governance. I would arguably say that the curse is not the natural resources but the culture behind the Governance. The resources merely exasperate the issues. It is worth bearing in mind that SSA is fairly new to independence. Most SSA countries were given independence in the 60’s but some were still not “truly” independent until later, South Africa’s apartheid as an example. The result has been countries coming to grips with taking over Governance, yet being propelled into the fast moving global market that has strong interest for what they have. With good Governance the curse turns into a blessing as can be seen from Botswana, who has one of strongest transparency ratings in SSA and a strong GDP per capita.