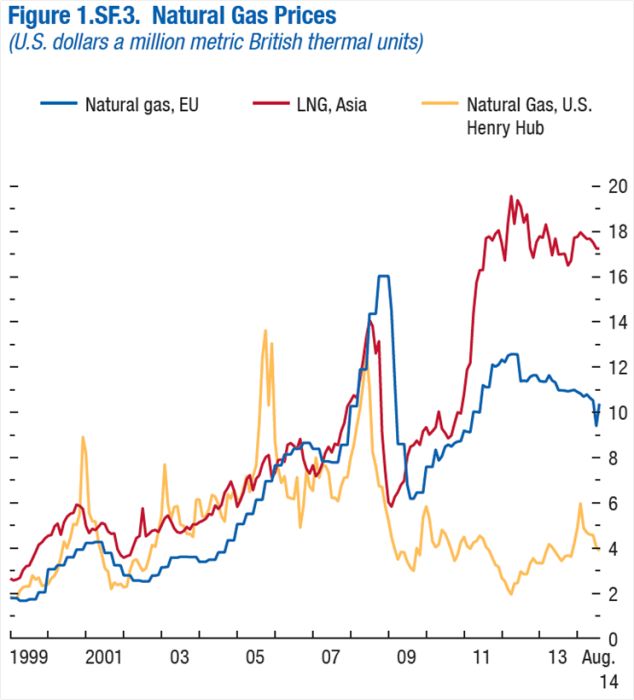

A global commodity, in economic or investment terms, is a standardised, homogeneous good that sells for the same price everywhere, subject to transport costs and tax. Oil is the classic global commodity. A chart from the IMF World Economic Outlook, just published in October 2014, shows that natural gas isn’t. But it probably will become more like a true commodity over the next decade.

The chart shows that natural gas is based up of at least three, geographically segmented markets: the EU, North America and Asia. While prices moved, until recently, in broadly similar ways in each market, that was because natural gas prices were linked to the price of oil. That linkage has now broken down almost entirely in the US and partly in Europe but not yet in Asia. The remarkable divergence of prices in the last five years is because of the rapid increase in supply of unconventional gas in the US (“shale gas”). That supply has caused US domestic prices to plummet but is not yet having much effect on the rest of the world because it is not being exported. The US is buying less gas from the rest of the world than it would have done otherwise, and the coal displaced by cheap gas is being exported to Europe instead, where it is partly displacing gas there. But the obvious arbitrage trade of selling US gas to Asia for four times its US price (ignoring transport costs) is currently not possible.

Why gas prices were linked to oil

Gas is more expensive to transport than oil and requires a large upfront fixed investment. Either you build a pipeline or you build equipment to turn it into LNG – liquefied natural gas, which can be transported in special ships to anywhere that has an LNG terminal. Both pipelines and LNG equipment cost billions of dollars. So normally investors won’t commit such capital without a long term contract. The contracts have historically been tied to oil prices, even though the direct substitution between gas and oil is limited. Both can be used as petrochemical feedstocks but gas is not much use for refining into petrol (gasoline) and oil is not much used in power generation, which is increasingly a major use of gas.

With most supply tied up in long term contracts there has been little scope for a spot market, a market in which prices are determined by short term demand and supply for immediate delivery. But that is changing. Gas is being discovered in many places around the world, in both conventional and shale forms. LNG terminals now exist in many countries, giving a much greater range of supply options for gas producers. In Europe, the pressure to liberalise power and gas markets has partially broken the link of oil and gas prices with gas increasingly trading separately on the basis of demand and supply. Long term supply contracts from Russia have seen prices renegotiated downwards as the original contract terms were increasingly out of step with spot prices.

The region yet to liberalise is Asia, which is also where the greatest demand is likely to be. Japan, lacking indigenous primary energy, is a structural importer of gas. Its demand has been even higher because of the closure of nuclear power stations following the Fukushima disaster in 2011. Long term, Japan is very likely to resume use of nuclear power because the alternative of importing all of its energy is too expensive and insecure. But China’s rapidly growing demand will more than make up the difference.

As and when the US starts to export its gas surplus then market forces will put great downward pressure on Asian prices. Anybody who is able to use cheaper American gas will. And it need not even be American gas. A true global market will emerge as gas in all parts of the world competes, with only transportation costs putting a price wedge between different demand locations. Gas exported to Europe could displace Qatari gas or gas from south east Asia which will look for an Asian market instead.

Oil: a true global market

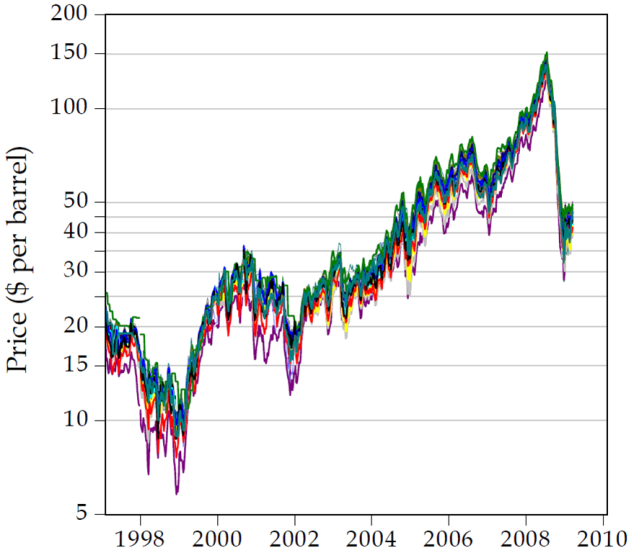

A classic piece of research by the US economist William Nordhaus showed that the oil market is a truly global one, measured by the criterion of what economists call the “law of one price”. His research showed that the prices of 31 types of crude oil round the world moved with a median correlation of 0.997, which is as close to perfect as you are likely to find. Compare the natural gas price chart from the IMF above with Nordhaus’s chart of oil prices from 1997-2009 here (note the scale is log of prices). Oil trades everywhere at a single price.

The consequence of this is that it trying to restrict supply from one or more countries (e.g. because of sanctions, politics etc) makes little sense because the market will simply reallocate supply. Prices are determined by global demand and supply and nothing much else matters except in the very short term.

The oil market is truly global because if a ship carrying uncontracted crude is sailing to the US but the price in Rotterdam’s spot market goes up, then the ship can divert at a few hours notice and head for where the price is higher. That is what puts a limit on global divergences of prices. The boom in LNG will eventually bring about something similar with gas, to the benefit of Asian consumers in particular.

Miriam Gordon

I finally understand the relevance of shale gas to the oil industry- thank you!

1. In the light of this, would you say the decrease in oil prices recently is primarily due to,

-the increase in American shale gas output meaning a global transition away from oil

-decrease demand as fall in manufacturing post recession

-a growing focus on renewable energy sources

or

-America using its shale gas domestically and so reducing its oil imports. As one of the largest oil importers I imagine this would reduce the markets demand significantly.

Or possible none of the above or all of the above!

2. In the article you say that measures such as sanctions make little sense as the market can reallocate supply. By this do you mean they have little effect on the targeted country (as Iranian sanctions seem to have had considerable effects)? In which case sanctions on Russia concerning Ukraine would be a poor political weapon?

Simon Taylor

There is a good analysis of the links between oil and gas at the FT blog of Nick Butler, former BP energy expert and formerly at Cambridge Judge Business School. http://blogs.ft.com/nick-butler/2015/01/04/after-the-oil-price-fall-is-natural-gas-next/