I think Karl Marx somewhere said that common sense was a poor guide to understanding the social world. If he actually said this (I can’t find a source) he meant it from the perspective of someone trying to show that what might seem like freely agreed wage deals between labour and employers (“capital”) masked an underlying imbalance in power that meant workers were exploited. His explanation for this process (the labour theory of value) didn’t work but his wider observation about understanding social forces, including economic ones was correct.

From a more orthodox direction comes the view that raising the minimum wage to $9 an hour, as urged by President Obama in the State of the Union Address, will worse America’s already serious joblessness problem. At an MFin dinner recently, a couple of people made this argument with a weary “This is obvious, why don’t politicians get it?” tone.

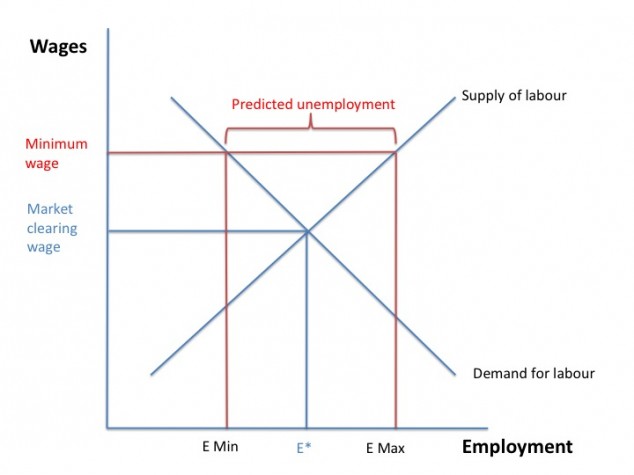

Their argument is a mixture of common sense, filtered through elementary microeconomics. In a simple demand and supply framework, if you raise the price of something, the demand for it goes down. If “it” is labour then surely, obviously, a minimum wage which sets a price higher than the market would have set on its own will raise unemployment. The standard diagram looks like this. The demand and supply of labour are equal at the market clearing wage. If a government sets a higher minimum wage than this it causes unemployment because there is more supply (people willing to work) at that level and less demand (employers willing to hire them).

This is common sense, consistent with elementary microeconomics – and wrong. Economists have studied the empirical effects of minimum wages ad nauseam. And the findings are pretty consistent, that minimum wages do not typically reduce employment. There is no reason, based on this evidence, to believe that a small rise in the US minimum wage will increase unemployment. The latest report, by the Center for Economic and Policy Research is available here. The author of the report, John Schmitt, describes the minimum wage as “one of the most studied topics in economics”. And Oregon Professor Mark Thoma’s Economist’s View blog has this interview with distinguished empirical microeconomist David Card about his work on minimum wages.

But there is a bit of a mystery as to exactly why not. The solution probably lies in the fact that the simple textbook model shown above assumes that labour is a homogeneous commodity, and that firms are all alike and operate in perfectly competitive markets. As this interesting post from Richard Green of USC argues, years of labour economics research have shown that things are more complicated than this. Employers, or at least a lot of them, have some degree of monopoly power over employees. Even a small corner shop has a bit of monopsony power in respect of whether and who it hires. (Note that the word monopsony refers to monopoly power when buying e.g. government funded health schemes can get a discount on prescription drugs because they buy in bulk as a single purchaser, unlike in the US).

Employers may therefore pay a little below the theoretically market driven competitive wage, and produce less than a competitive market firm would. (These are general results from the analysis of monopoly power. When businesses have monopoly power in the product market they charge more than a purely competitive firm would charge and produce less, both of which reduce economic efficiency).

A firm in this situation is in equilibrium – any single firm forced to raise pay it would lay people off. But if there is a general increase in pay across all firms, as with a rise in the legal minimum wage, then firms don’t face any competitive threat from being undercut by other firms. They can pay a bit more without having to cut employment. They may pass some of the cost on to customers if the market allows it. Or they may absorb some in lower profits. And by countering the monopoly power the minimum wage might actually push the economy closer to where it would have been with a more competitive structure.

But firms may find that the higher wage pays for itself, at least in part, through reduced absenteeism and staff turnover and higher effort and greater investment in training. These positive results, which could be very small for a corner shop but quite significant for a complex firm, arise from the fact that the employment relationship is more rich and complex than an arms length spot transaction to buy a commodity, which is what the standard simple microeconomic model implies. Some employers already deliberately pay more than the going rate to attract the best workers, whose higher productivity justifies the higher pay, which economists call an efficiency wage argument. This matters much more in some jobs than others, depending on skill levels, customer impact, the cost of high turnover etc.

Labour economics has explored the many ways in which employment relations vary, within a rational choice context. Non-economists go further and point to non-rational forces such as fairness, gift-exchange and social norms as having additional value in explaining actual employment arrangements. Most economists dispute the significance of these forces, except in so far as they form part of the rational choice analysis, but everyone agrees that basic microeconomics, dressed up as “common sense” is a poor guide to understanding minimum wage policy.

Note: Some additional and fascinating reading on the history of the minimum wage in the US here.

John

Dear Simon, I read about this subject somewhere else recently but sadly I can’t remember where. It’s fascinating. Has anyone written about how to find the sweet spot balancing the level of minimum wage with overall benefit to the economy; and what the key parameters are?

David

If McDonalds in the future has to pay its staff USD 9 per hour instead of USD 7 per hour, will they reduce the number of staff? Obviously not because the demand for McFood isn’t going down.

Rather, they will make slight less profit or the might increase their prices.

Hence I also believe that increasing the minimum wage will not increase unemployment .

Downside: I did use common sense to come to that conclusion so obviously it must be flawed .

Andreas K.

The demand for McFood is actually more likely to rise as a result of minimum wages. I’d guess that income elasticity of low-income consumers for McDonald’s food and other low-cost goods and services is reasonably high. In other words, the low-income consumers who earn a few dollars more as a reuslt of the higher minimum wage are likely to spend these dollars for (relatively cheap) goods that have been produced by other low-income workers (such as McDonalds employees).

Increased demand for goods/services produced in low-income sectors may thus (partly) offset the higher labor costs.