I’ve mentioned before the long running argument about whether The Wizard of Oz is in fact an allegory of the gold standard. Those who think it is point to the book having being written during the arguments about bimetallism (whether to use silver as well as gold for monetary purposes) in the late nineteenth century USA, when farmers suffering from debt deflation believed that blind adherence to gold as the sole backing for currency was ruining them.

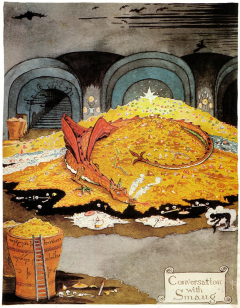

Economists are now examining the possible monetary basis of JRR Tolkein’s Middle Earth, brought back to the screen with the first of three episodes of The Hobbit. Without giving away too much of the plot, a group of dwarves begin a quest to regain control of a vast hoard of gold and jewels that was stolen from them by a dragon called Smaug.

Economists are curious about the effects on the Middle Earth economy of: i) the mining of so much gold; and ii) the abrupt prevention by Smaug of this gold entering the economy. Gold has been the traditional monetary base of many societies in the real world. An important phase of European economic history began with the transfer –well, theft – of vast amounts of gold and silver by Portugal and Spain from the Americas to Europe in the sixteenth century. It brought great wealth and power to the Kingdom of Spain but later led to price inflation, which monetarist economists would of course expect.

One bank to rule them all

Anonymous bloggers Morton and George argue that the dwarf King Thrór was right to hoard so much of the gold, since if it had flooded into the economy it would have led to inflation. Equivalently, the price of gold would have collapsed because it was so plentiful. So what the film of part one of The Hobbit (the length of which itself suggests inflation, as they say) criticises as avarice and delusion was actually sound central banking practice. Morton and George argue that what looked like a useless pile of treasure was actually a sort of sovereign wealth fund.

Obviously normal central banking rules don’t tell you what to do when a dragon takes your gold and forces your people into exile. Smaug stops the flow of new gold into the economy (mining ceases, given the risk of instant cremation) and stops the use of the existing stock. In this respect the plot is closer to that of Goldfinger, in which the villain has a brilliant plot to irradiate the US gold supply, thus taking it out of circulation and instantly increasing the value of all other gold in the world.

Another blog then takes up the theme by arguing that the sudden withdrawal of gold from the economy by Smaug was equivalent to a large monetary shock that caused a fall in economic activity, impoverishing the dwarves. I won’t reveal the plot ending but it is consistent with the monetary shock interpretation of Smaug.

Note that this view requires that we assume the Middle Earth economy is New Keynesian, meaning that there are sticky prices and other rigidities. In a Real Business Cycle world the withdrawal of gold would have led only to price changes and no real effects, since monetary shocks can have little or no impact on the real economy. Regrettably the conventional dynamic stochastic general equilibrium models used by most central banks lack a dragon equation, though it could probably be added without difficulty.

In the spirit of The Wizard of Oz we could go a stage further and see Smaug as a metaphor for capricious or inept central banking policy. Perhaps he should have been called Alan.

Further viewing (as recommended by my daughters).

Leave a Reply