A crumb of comfort during the 2008/09 financial crisis was the thought that we were living through historic times. But to face another historic event barely a decade later is perhaps a bit much.

The financial – macro relationship

The so-called global financial crisis (which was actually a crisis of the US financial system and the wider dependence on dollar funding in Europe and Asia) was a case of the financial system causing a shock to the real economy. Economists refer to the “real economy”, not in contrast to some virtual or unreal one, but meaning the goods and services that actually matter to people. By contrast the financial system is there to serve the real economy, and financial assets are merely claims on real resources with no intrinsic value. (If you really think the end of the world is coming, dollar note and Eurobonds are unlikely to be as useful as a tin opener).

A seriously mistaken theme in macroeconomic theory before the financial crisis was that the real economy was somehow independent of the financial sector. Money, financial asset prices and credit could fluctuate but the paths of GDP and employment would be determined by real forces (supply and demand).

This view ignored repeated warnings from history. What was once known as the “classical dichotomy” between the real economy and money was shown to be completely wrong. A real estate bubble led to a reversal of credit growth, hugely reinforced by the collapse of what became known as the “shadow banking system”, which was a set of interconnected financial transactions that reproduced the inherently risky maturity mis-match of banks (funding long term illiquid assets with short term liquid funding liabilities) but without the regulation, deposit protection and central bank liquidity back up that allows banks to run this mismatch.

The result was the so-called Great Recession, notable for its length as well as depth, but mitigated by government spending and tax cuts which followed the conventional textbook economics approach that was learned from the far worse 1930s Great Depression. The causation was clear: financial shock caused real economy damage.

This time it’s a real, not financial shock

The current economic crisis is starting in the real economy: it’s a particularly acute combination of supply shock (a huge fall in production because people aren’t able to work) and a demand shock (people have less money to spend and during quarantine have few opportunities to spend it). The falls in GDP which are just coming through in the data are faster and deeper than anything ever recorded and justify a truly historic response from governments and central banks.

Of course there may be a financial crisis on top of this, mainly caused by credit defaults. But it seems the banks are in much better shape than in 2008, and a degree of regulatory forbearance (essentially, temporarily pretending loans are good when they are really bad) may help keep the banks from foreclosing on companies that have suddenly lost most of their cashflow.

The financial crisis was frightening, and fear is a big part of economic causation in a crisis, but there were at least some rules: lend to solvent banks, provide unlimited liquidity. The Fed and other central banks followed those rules and avoided a much worse downturn.

But there is no precedent for the current situation and governments and central banks are having to improvise. One possible rule that still applies is that the risk of being too cautious is far larger than the risk of doing too much. Concerns about a very large rise in public debt should be put on one side. The UK saw an enormous rise in government debt after the Napoleonic wars, which ended in 1815, peaking at about 250% of GDP (roughly where Japan is today). Yet the early 19th century was the beginning of the greatest rise in economic growth ever seen in human history.

A rise in public debt is natural when one generation faces a crisis, the costs of which will be borne in part by later generations. You can think of this as a form of insurance. It’s not a “bail-out” but a rational way of protecting people and production from an external shock. Future generations will have their own crises and if we are wise we will leave them not just liabilities but assets in the form of institutions and mechanisms that cope with future viruses.

More generally, it’s helpful to think about a lot what the state does, not as “welfare”, with its pejorative meaning and implication of handouts from rich to poor, but as insurance. We insure against all sorts or risks, such as fire and car damage, which are well handled by the private sector. But economy-wide shocks such as unemployment, financial crises and epidemics cannot be handled by private insurance because they affect a large fraction of the population at the same time. This is therefore a role for the state, which is simply filling a gap left by a market failure.

This is not a black swan event

The original idea of a “black swan” , as brilliantly put forward by Nassim Nicholas Taleb, is an event that could not have been predicted from within the current range of thinking. Victorian British naturalists, having seen only white swans, had every reason to think that all swans are white, until it turned out that Australia had black ones.

This is a very different and more profound concept than a very unlikely event. Financial market participants still like to talk about 4-sigma events, meaning market moves that occur at the range of the probability distribution four standard deviations from the mean. This is silly nonsense: it has been known since Mandelbrot’s work in the 1960s that financial market returns don’t follow a normal Gaussian distribution, so these sigmas are being inappropriately applied, mainly because other probability distributions that may be more accurate are much more complicated.

Far from a global pandemic being either very unlikely or outside our range of thinking, it has been firmly a part of all sensible risk scenario planning for decades. Bill Gates’ much watched 2015 TED talk was quite clear on this. So failing to prepare is that much harder to understand.

While it is little comfort for those who will die from COVID-19, humans have co-evolved with viruses and bacteria and have suffered repeated epidemics, especially since the domestication of animals began about 20,000 years ago. Plagues have killed up to a third of the population in Eurasia at various times of history. Western hemisphere populations suffered massive losses from the microbes forcibly brought to them by European conquerors.

This means that those of us living are the survivors of repeated attacks, and have a lot of natural immunity plus an immune system that can cope with all but the worst cases (as long as it is in reasonable health). For what it is worth, this is therefore not an existential risk, even though the cost will be unimaginably high.

People in a crisis

I am enormously impressed by the way colleagues at Judge Business School and St. Catharine’s College have calmly put in place emergency measures to ensure we can protect ourselves and keep a large part of our educational services going. Not everything has gone smoothly, but there is something in the revival of that World War II advice to “Keep calm and carry on”. The difference is that carrying on involves staying at home for most people, but we are lucky that there is so much technology to keep us connected, much of it free.

Today I had my first Zoom tutorial and last week we started recording lectures for next term. I ask students to be a little forgiving, we are learning new technology and new techniques for online teaching. But I hope the results will eventually be as good as the original.

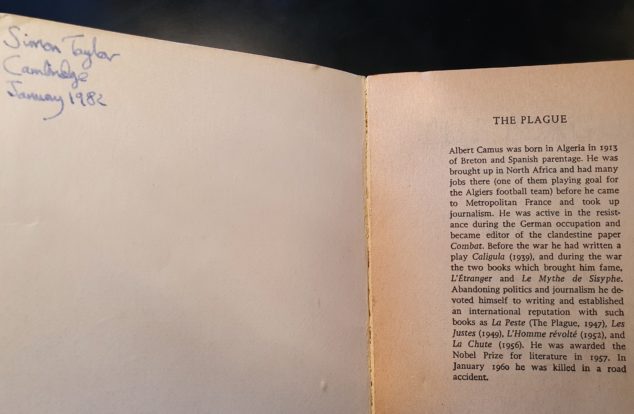

Last year I ended my MFin lectures on the international economy with a quotation from Albert Camus’ novel The Plague (I have to read it in English – the original title is La Peste). Apparently loosely based on the true story of a town in French occupied North Africa which was entirely quarantined at a time of cholera, it describes how people cope in such an extreme situation. Characters in the book rage, deny, adapt, lapse into sullen acceptance, revealing the range of human behaviour in a crisis. Unsurprisingly sales have surged recently, but my personal copy reveals that I bought it in 1982 (from the days when I bought physical books and inscribed the year of purchase).

Like many young people at that time, I was going through a vaguely existential phase, which involved wondering about the meaning of life and envying the French for their apparently effortless cool. (If you are at a stage in life where you face similar thoughts and you’re thinking of spending time exploring French existential writers, my mature advice is: don’t.)

Unlike the other existentialists, Camus was essentially optimistic, at least in this book. The sentence I thought worth passing on last year, and still do, if you will interpret “men” as “humankind”, is:

“there is more to admire in men than to despise.”

Peter Rawlings

Wonderful Simon. Thanks for the reading tips !

Sheryl Xue

Very impactful insights. From this global health emergency, the line between conventional fiscal policy and monetary policy would not be that clear-cut and deep debt monetization as ‘new normal’ is what we expect for years to come.

Again, within the context of the health emergency, which has chain reaction in IS and LM shocks, generational equity could justify the current trend and practice in policy combination; as the current generation passes on future generations more optimally designed institutional arrangements (hopefully we humans will learn more humility in history) in compensation for redistributed tax burdens.

We shall remain vigilant about the potential impact of this new wave of financial dominance both politically and financially. Whether any paradigm shifts in the financial market? But first of all, let us stay safe and healthy to witness how the wheel will be greased.

Isaac Katz

A great read, as always.

I am intrigued by the title and whether you think it is different this time. To me, the role of Government in causing the downturn by imposing (albeit perhaps reasonable) restrictions on business does make it different. In particular, the idea of ‘stimulus’ is different if Government has decided that business cannot operate. Also, the way we recover from the downturn must be different too, because it depends on Government decisions on when and how the restrictions are removed. Apart from these differences, now that the world is more interconnected than ever before, the impact of ‘closed’ economies (at least in terms of the movement of people, if not trade) must be greater than ever before socially and economically.

It is interesting to ask what economics can tell us about how best to address the current crisis. The reliance on medical professional to advise Governments on the appropriate course of acton reveals that economics isn’t trusted to put us on the right path. This probably means that the unavoidable tension between minimising loss of life and minimising the financial impact has not been properly tested. If that’s right, Governments will be to responsible for the outcomes, which will be worse than necessary. In that sense, perhaps this is no different from other recessions – but in many other respects it looks very different (to me, at least).