The concept of natural capital applies to natural resources and the natural environment the ideas of economics and accounting used in the conventional analysis of capital assets. It provides a rich framework with which to think about how to value ecosystems, rivers, fisheries and the atmosphere though the problems of how to implement and quantify natural capital are very considerable. The UN, World Bank and recently the UK government have adopted natural capital as part of their thinking. At Cambridge Judge Business School we are hoping to find external donor funding for additional research in this area, which has the potential to link many different disciplines and activities in environmental policy and corporate strategy.

What is capital?

A capital asset is something which yields a flow of benefits into the future. The definition requires that these benefits last over time (more than just one year in practical accounting definitions). The benefits can be cashflows, as in financial assets, or they can be economic benefits in kind, such as the benefit of having a place to live in the case of a house. But they can also be intangible or non-economic benefits, such as the pleasure from looking at a painting, the beauty of a landscape or the amenity value of a lake for sailing. Capital is a very flexible concept and establishes that there is a stock of something now that yields a flow of future benefits. The different types of capital are summarised in this diagram.

Classical economists in the eighteenth and early nineteenth centuries classified the factors of production into land, labour, capital and enterprise. Land is a form of capital that was so important that it deserved its own category, given that these writers lived at a time when most income still came from agriculture. By capital they meant the stock of other assets such as factories, roads and machinery. In modern national accounting we refer to produced or manufactured capital.

(By enterprise the classical economists meant the combination of entrepreneurial risk taking and the managerial combination of other factors into actual production. In the twentieth century risk taking and management have become distinct activities as the ownership and control of companies can easily be separated through floating shares on the stock market.)

The classical economists would have found it easy to understand an extension of the concept of capital to human abilities and skills that we now routinely call human capital. A person has human capital if they possess attributes, either inherited or learned, which allow them to do things better in future. In the economic or business sphere this human capital makes them more productive, which would typically make them better paid. But that depends on whether there is a market for their skills and what the market value is. A talented singer may make a lot of money, but only if they sing what is in popular demand. A brilliant stone mason has great skill but the demand for them is not as high as it once was so stone masons are not among the highest paid workers anymore.

The importance of human capital to advanced economies is hard to overstate. Perhaps the best illustration of its importance is the astonishing recovery of Japan and Germany from the ruins of the second world war. Both countries lost a very large part of their physical capital – factories, houses, infrastructure. At least 50% of all houses were destroyed in Germany for example (source: Richard Overy’s recent book The Bombing War: Europe 1939-45, reviewed here). Both nations were helped by large investments by the USA but this was nowhere near enough to replace their lost physical assets. But the nation’s human capital was more intact (though the Nazis’ anti-Jewish policy deprived the German economy of many Jewish scientists and engineers who fled to the USA, UK and later to Israel). The German and Japanese people still had a great deal of productive value in their knowledge and skills and were able to rebuild their broken countries and catch up with the less damaged advanced economies in less than a generation, a remarkable achievement unthinkable if economic development were mainly dependent on physical capital.

Economists in recent decades have also studied social capital, something that sociologists and anthropologists had long before identified as an important aspect of how societies work. Social capital refers to a form of human capital that makes people successful in a more general way than is captured in a specific skill or aptitude. For example it could refer to knowledge of how to behave in social situations (what words to use, which cutlery to eat with) which allows one person to get on with others more easily.

Importantly there is a network effect in social capital that is potentially powerful in economic success. The ability of a group of people to cooperate because of shared understanding, values and norms is increasingly recognised as an important part of the success of rich countries. Much of this social capital is embodied in institutions such as the rule of law. If you put exactly the same resources together in say Germany and in Nigeria, you would probably get more economic productivity in Germany, because it has a highly effective legal system and because (nearly) everybody sticks to the rule of law – they have internalised the norms of the system and trust that most other people will do too. This is less true of lower income countries such as Nigeria or even China, where the rule of law is less well established.

Trust is therefore one of the most important assets in rich countries and is an important form of social capital. It is a network benefit because trust depends on relations between people and the higher the average levels of trust, the more likely people are to stick to verbal promises and not have to get every agreement verified by lawyers or other credible agents of enforcement, such as gangsters. Such mechanisms are costly and slow down the process of economic production.

Social capital has a darker side because differential possession of social capital among people confers power on some of them, so some authors emphasise the importance of social and cultural capital in explaining inequality and power relations. They are following in the Marxist tradition. Karl Marx wanted to expose the true sources of inequality in capitalism that arose from the nature of capital, though he meant capital in the more conventional sense used by the other classical economists.

It’s only a small further step to thinking of natural systems such as rivers, soil and lakes in terms of natural capital. These are all resources which yield a flow of benefits into the future. We routinely think this was way when considering whether an area should be designated a national park, meaning that it is protected from development that might damage it. The underlying idea, which has been around for at least 30 years, is that there is something of intrinsic value that the current generation should protect for the future. Pre-industrial societies have rules and mechanisms for protecting such assets. But the coming of industrial society often damaged or destroyed these rules, leaving only the market economy in its place.

And it is the absence of markets, or at least well functioning markets, that makes the concept of natural capital potentially valuable in ensuring that public policy and corporate behaviour don’t accidentally damage the environment.

Natural capital

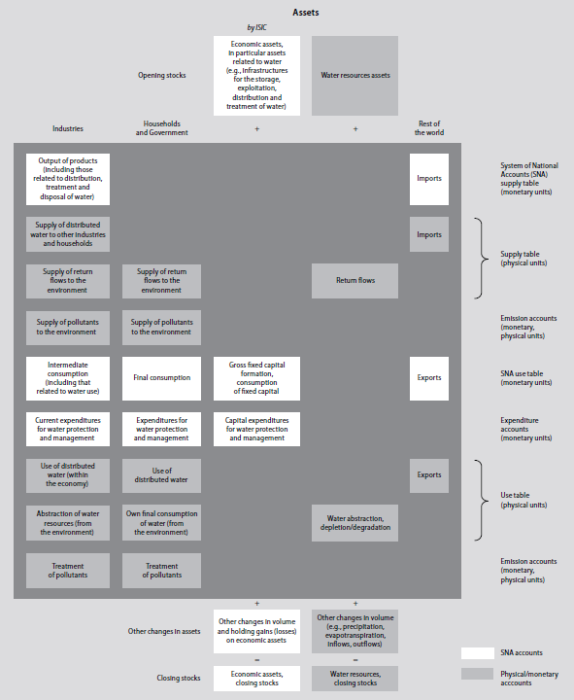

For natural capital to progress beyond a useful concept or a slogan it needs to be made operationally workable. A big step in this direction was the System of Environmental-Economic Accounting (SEEA) which was published and ratified by the United Nations in 2012. The SEEA shares a conceptual framework with the UN System of National Accounts (SNA) which underpins macroeconomic reporting by countries. It provides a detailed set of tools to estimate the value of environmental resources, chiefly energy, water, fisheries, land and ecosystems and agriculture. These tools are intended to help governments and private citizens such as companies to measure more accurately their wealth and income, taking into account any damage done to natural capital which is omitted from conventional income statements.

For example, there is a detailed analysis of SEEA for the water sector (which is available on the UN website in all the main UN languages except, oddly, Arabic). The report provides categories, criteria for measurement and a framework for detailing stocks and flows, just like the conventional national accounts Here is the summary. It’s too detailed to read clearly but gives you some idea of the richness of the framework.

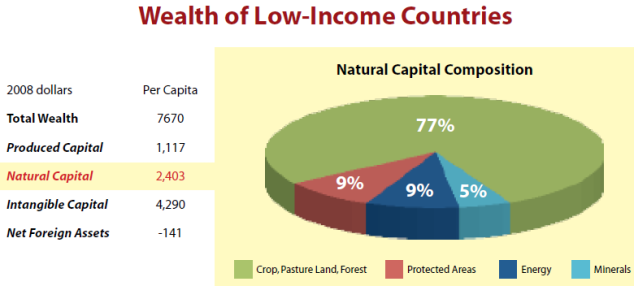

As the organisation perhaps most central to the global fight on poverty, and one staffed mainly by economists, the World Bank has been in the forefront of making natural capital an operationally useful concept. It builds on the UN SEEA and works with partners in turning the concepts into data and policy. The World Bank’s own estimate is that natural capital accounts for 36% of the total capital (wealth) of low income economies (see diagram below). Note that intangible capital includes human capital and produced capital refers to conventional economic capital.

Example: “income” from ecosystems

Valuing assets – estimating their capital value – means identifying then quantifying the flow of benefits. The benefits of a government bond, a financial asset, are very clear – a flow of income in the form of coupon payments. But what about an ecoystem? The UN (Millenium Ecosystem Assessment 2005) classifies the four sources of benefit or services from ecoystems as:

- provisioning services: e.g. food, water, timber

- regulating services: providing natural protection against flood, drought and disease

- cultural services: recreational and aesthetic benefits

- supporting services: soil formation, photosynthesis and nutrient cycling.

- direct use value: both by directly extracting resources and in tourism or leisure, such as kayaking on a river

- indirect use value: the cleaning of water by aquatic organisms, climate regulation, pollination and soil replenishing

- option value: the value that a resource might have in future, perhaps as yet not known, such as tourism potential or new drugs from plants

- non-use value: the value of maintaining environmental resources beyond their utility, including the value of preservation for future generations,

Direct use value is relatively straightforward because there is often a market or payment involved. The valuation gets progressively more difficult the further away from direct use value we go. But that is a challenge that environmental economists are taking up. There will be a range of opinions, just as there is in conventional valuations, of a company for example. But the framework allows these disagreements to be clear and constructive. Important categories of value that were omitted completely before are at least on the valuation agenda. Many of these values have been taken into account in the past in social cost benefit analysis (e,g. in decisions as to whether to mine resources in areas of wilderness) but the new framework is more comprehensive and thorough.

Even with imperfect or contested values, the estimates of natural capital can lead to better decisions. In Moving Beyond GDP the World Bank gives the example of the valuation of mangrove swamps in Thailand. If the value of the mangroves as a natural barrier to flooding is included it makes no economic sense to convert them to shrimp farming. Using only market values of income and capital would lead to a bad decision.

In the UK the Department for the Environment, Food and Rural Affairs (DEFRA) set up a Natural Capital Committee in 2012, and produced the first national state of natural capital report in 2013, the first of its kind in the world. The committee, which consists mainly of economists and ecologists, concluded, unsurprisingly, that the country’s natural capital is in decline and urged more and better measurement of the changes in natural capital and valuation of it. With superior measures of the British natural capital, the government can reduce the risk of damaging it, which is another way of saying it can adopt sustainable policies. The report is a very well written guide to natural capital and environmental policy more generally.

National versus corporate accounting

At this stage some governments are using natural capital or equivalent measures to inform their policy. But what is really needed is for private decision makers, especially companies, to use equivalent concepts in their decision making. Many companies already produce reports and statements of their environmental impact and policies. If companies could integrate these impacts into their main accounting, the higher prominence might lead to more impact on key decisions.

Corporate accounting is much older than economic accounting, though the two are broadly consistent, and has a slightly different role. Accountants are perhaps cousins to economists but they are in some ways more stringent. Accounting rules require companies to recognise future liabilities but only to put them on the balance sheet if they can be quantified with a reasonable degree of accuracy. This preserves confidence in what is captured in the accounts but it means that known but hard to quantify measures such as the impairment of a river’s value by putting waste into it might by omitted from a company’s income statement.

Fortunately the evidence is very clearly that most companies want to do a better job and are crying out for operationally workable tools to do so. That’s why more research on natural capital is so important, particularly in getting beyond just government decision making and providing detailed, everyday accounting tools that can be used by companies.

Key resources

System of Environmental-Economic Accounting

UK State of Natural Capital Report 2013

Argument for environmental capital to have a core role in economics teaching

Leave a Reply