The Bank for International Settlements (BIS) produced its triennial detailed review of foreign exchange (FX) markets on 5 September 2013. What we learn from this is that the FX market is vast, growing and still dominated by dollar trading in London.

It’s vast

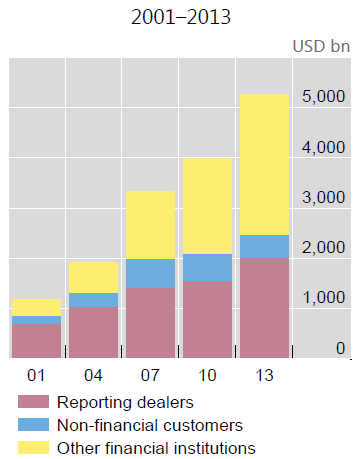

The global FX market turns over $5.3 trillion a day (which is about $61m a second). And it’s still growing, as this compares with $4.0 trillion in the 2010 survey. The great majority of this trading is done by financial institutions, dealers and banks. Only a small part is associated with non-financial institutions (e.g. companies needing FX to buy or sell good and services across borders). This chart shows the growth and the mix of counterparties (i.e. who is buying or selling).

As Timothy Taylor explains, trade and “normal” capital flows cannot explain much of the volume of FX trading, which must be driven by the daily hedging and speculative positioning of banks and other financial institutions.

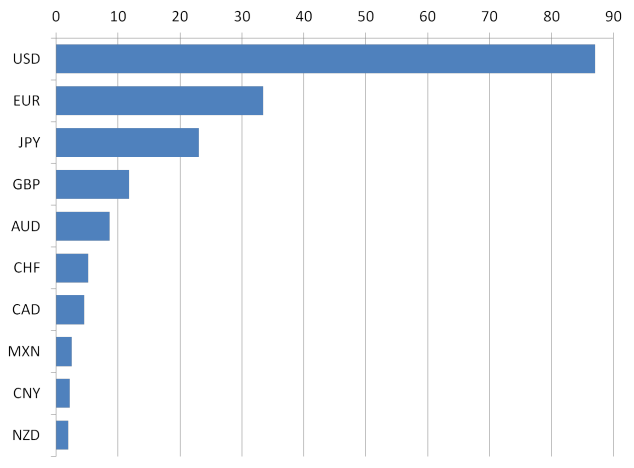

Trading is still mainly into/out of dollars

Some bloggers have noted that the list of ten currencies most traded now includes the Chinese RMB for the first time. But the main message of the survey is the continued dominance of the US dollar, with the other rich country currencies picking up most of the rest of the volume. China is in the top ten (with a market share of 2.2%) but so is the Mexican peso. In both cases this reflects rising trade and some liberalisation of those currencies’ markets. But the RMB is some way of becoming a new reserve currency (see this blog for interesting analysis of the historical precedents for such a change and this one for an analysis of what it means to be a reserve currency). Here is the top ten by market share (%).

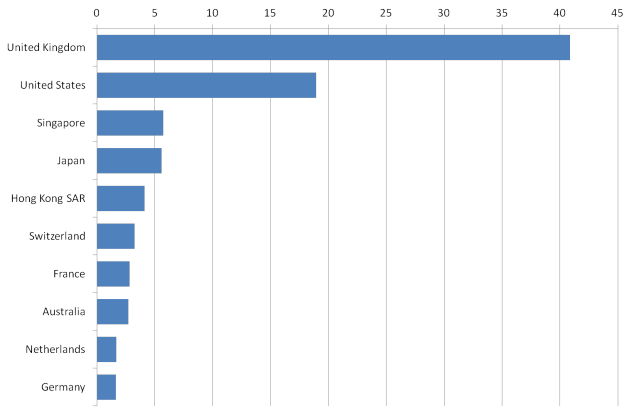

London is still the largest FX market

Recent attempts by the British government to support the City of London’s aim of being the major offshore trader of the RMB as it becomes more internationalised build on a great strength. London is the main centre for international financial transactions, including equities and FX. London has 40% of global FX trading (see chart).

Dora Bacon

Every stock marketer now is successfully trading in FX. Actually it’s all about learning skills how much you loss makes you more resistible. You loss more you learn more.

Simon Taylor

So those who have learned the most are also bankrupt…?

Dora Bacon

In a way, but you never know when you are going to win or lose. By the way learning skill always makes you to achieve something.

Sakura FX Algo

Well, I also in believe in that manner. But there is a better strategy to know about trading.