Remember all the commentary on the impending disaster of US federal government deficits? Which would force the cutting or closure of Medicare, Medicaid, Social Security and anything that helps low income or economically unlucky people? Well the US still has a long term problem with rising spending owing to ageing and health care costs, but the picture is manageable, especially if the recent slowing in health costs turns out to be permanent.

And the near term problem has vanished, as it was always likely to, because economic growth is gradually picking up.

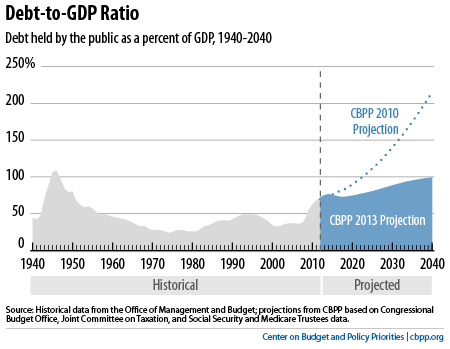

Here is a chart from the latest report from the non-partisan Centre on Budget and Policy Priorities (CBPP). It shows their latest projections of the federal deficit compared with their forecasts in 2010.

The projection still shows a rise to around 100% debt to GDP by 2040, which is too high, but there are three decades to work on this, through a mixture of policies on health costs and probably extending the retirement age. But the explosive scenario has gone, largely because the US is moving out of recession, plus a fall in projected Medicare costs owing to the Affordable Care Act (“Obamacare”) and the partial reversal of the Bush tax cuts. More detail (and a list of other, broadly similar projections) here.

Overall, despite its problematic political system, the US has emerged better from the great recession than the UK or the rest of Europe. Not what most people would have predicted back in 2009.

Leave a Reply