Timothy Taylor’s blog comments on the latest World Bank Africa’s Pulse report, which has some encouraging data and analysis about the African economy. Having for so long been the laggard region of the world economy, sub-Saharan Africa has sometimes seen a growth spurt on the back of a temporary commodity price boom, only to see it fade as the eventual price bust arrives. There is room for cautious optimism that the foundations of African GDP growth are a bit more robust this time.

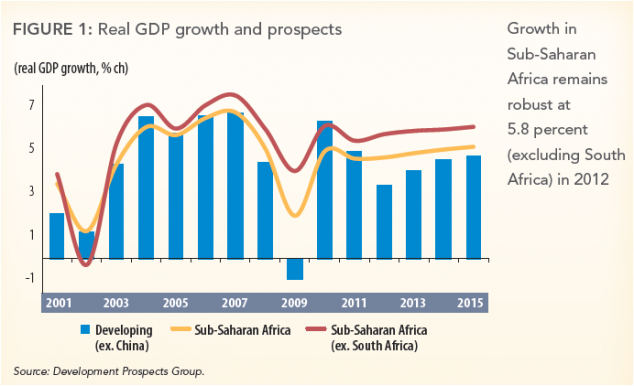

This chart from the April 2013 report shows that GDP growth has bounced back well after the global financial crisis and the Bank expects it to continue for the next couple of years at least.

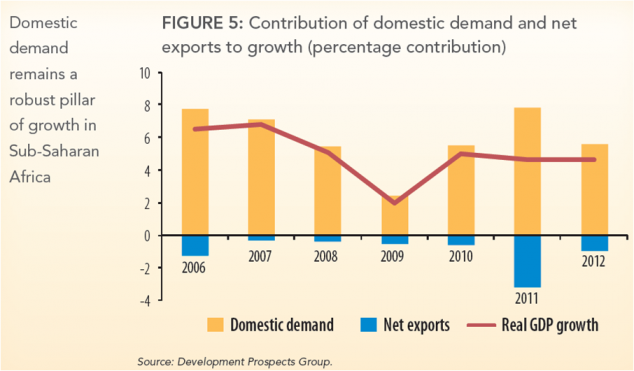

The reason for being hopeful that Africa’s economy is not merely a high beta play on Chinese demand for commodities (which is clearly slowing as Chinese GDP growth decelerates) is shown in the next chart. The majority of demand growth in sub-Saharan growth is domestic, and this seems strong enough to offset a slowing in export demand growth.

Net exports have been negative in most years, since African economies need to import a great deal and it is quite normal for a fast growing developing economy to run a current account deficit (negative net exports). Strong domestic demand has kept GDP growth high enough to make a dent in long term poverty levels, though not quite as fast growing as during the pre-crisis boom.

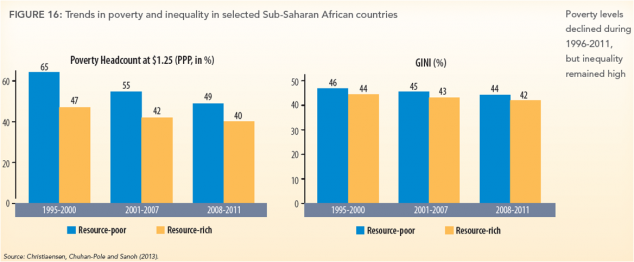

Poverty levels have been falling but remain very high by global standards. The World Bank uses $1.25 a day as its basic poverty measure. The next chart shows that in resource-poor African economies nearly half the population is still living on that amount. Inequality (measured by the Gini coefficient) is also high, though not as high as in Latin America. Aside from the rather exceptional case of China, poverty reduction is a long term business that requires a decade or two of steady per capita GDP growth, plus supportive government policies on health and education. It’s far too soon to declare victory in Africa but the trend is encouraging.

Richard Agala

The middle class population in Sub-Sahara Africa is estimated to hit 626 million by 2020 and 1.232 billion by 2030. If these forecasts are anything to go by, then we expect consumer demand to gather greater momentum and provide additional support to the strong domestic demand.