Some people who know me don’t believe it, but as a child I wasn’t interested in international politics. But, like most people in Britain in the 1970s, I knew the name of the Saudi oil minister, because he was a household name. Ahmed Zaki Yamani, known in the West as Sheikh Yamani, was the oil minister for Saudi Arabia from 1962 to 1986, including the period when OPEC, under Saudi leadership, quadrupled the price of oil in 1973-74. At a time when the post-war Bretton Woods economic system was already falling apart, and the western economies had become used to endless cheap oil, the oil “shock” as it became known, had a dramatic effect both on western economies and on their citizens.

The 1970s oil “shock” was both economic and political

Sheikh Yamani, who died in February 2021, was born a commoner and acquired the honorific of Sheikh when he became oil minister in 1962. He was the key figure in strengthening OPEC (the Organisation of Petroleum Exporting Countries), a cartel of countries which wanted to take back power from the dominant “Seven Sisters” western oil companies that controlled oil supply and pricing. Those vertically integrated oil companies either owned or controlled upstream oil production in the Middle East, and shipped it to their retail and marketing arms in the rich countries. With the support of their home governments, chiefly the US and UK, they kept a steady, profitable supply of oil flowing cheaply to the rich economies, at the expense of the countries which actually produced the oil. OPEC eventually changed the balance of power, pushing up prices by controlling supply in a coordinated way. Saudi Arabia, as the biggest supplier and with the capacity to quickly adjust the volumes pumped, emerged as the leader of OPEC, under the diplomatic genius of Sheik Yamani.

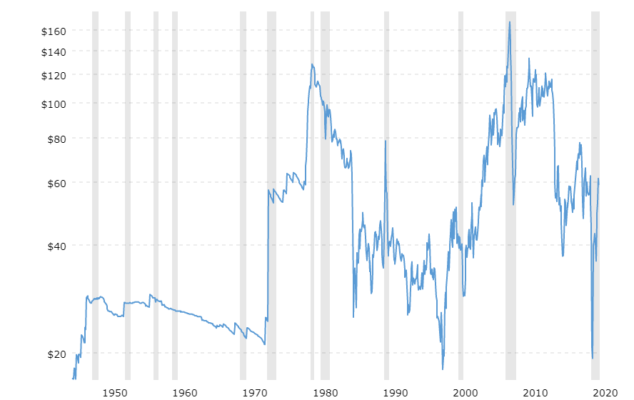

The chart below, which shows oil prices in real terms (in 2021 prices) shows how dramatic the price rise in 1973/74 was, followed by a further doubling in 1979 because of the Iranian Revolution. Although real prices were a little higher in 2008, and prices remain volatile, the world has not experienced such a sudden price change since the 1970s.

Real oil prices saw unprecedented rises in the 1970s (WTI $ per barrel, 2021 prices, log scale)

Cartels struggle to succeed

Economists in the 1970s pointed out that in the long run, any cartel’s attempt to control the price would be frustrated by a combination of cheating, and of market forces causing an adjustment of demand to other energy sources and a search for new supplies.

Although the long run is a very long time, both of those points have been largely borne out by history. Firstly, cheating, especially by smaller producers, has been a constant problem in maintaining OPEC production targets, with Saudi Arabia occasionally having to punish these producers by temporarily flooding the market. Second, Western consumers, especially in high-tax Europe, shifted to much more fuel-efficient cars. Thirdly, high prices made new, competing sources of supply profitable, such as the North Sea. The result was that oil prices collapsed in the mid-1980s, one of several factors leading to the end of the Soviet Union, which was a major oil exporter, but not a member of OPEC (Russia is still not a member of OPEC but cooperates with it through what is informally known as the OPEC+ group of countries). The Saudi King Fahd sacked Sheikh Yamani as oil minister in 1986, at least partly owing to OPEC’s inability to push prices up again.

Although OPEC has, by closer cooperation with many of the more recent oil producers, more or less controlled supply, it has been undermined by the “tight oil” (shale) revolution in the US. The US was always both a big source of oil and a big user of it. As domestic demand overtook supply, the US became vulnerable to OPEC, as shown dramatically by the long queues at gas stations following the Arab embargo on oil exports to the US because of its support for Israel in the Yom Kippur war of 1973.

Man reading about gas rationing in US 1973, sign behind shows no gasoline available

But high oil prices, new technology, remarkable American enterprise and highly forgiving US capital markets eventually led to the astonishing rise in US oil supply from 2012, which has changed both the economics and the politics of the global oil industry.

Even after the 1970s price rises, Sheikh Yamani aimed to keep oil prices from rising too far, because it risked choking off long term demand (see above). But this caution also reflected the Saudi goal of honouring an historic agreement made between President Franklin D. Roosevelt and King Abdulaziz ibn Saud on a US warship in the Great Bitter Lake of the Suez Canal. (The long term consequences of the US-Saudi alliance, which continues to this day, are told in the fascinating, though controversial, 2015 BBC film Bitter Lake.)

Equally importantly for Saudi economic independence, Sheikh Yamani oversaw the nationalisation during the 1970s by the Saudi Kingdom of the oil company Aramco, which was previously owned by a consortium of US oil companies.

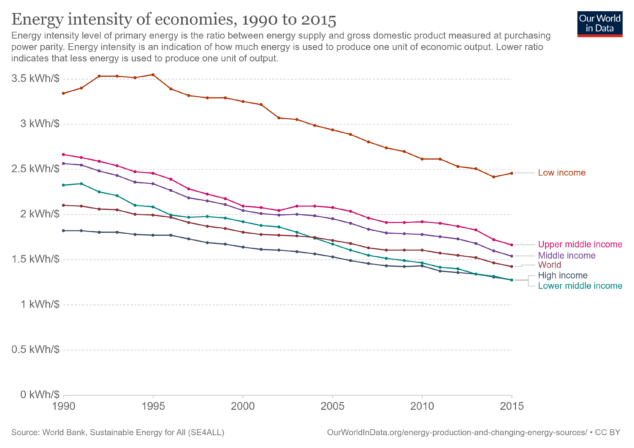

Oil has become less important in international politics, despite a large rise in demand from newly industrialising countries, particularly China. This is partly because higher prices encourage greater efficiency of use, and the world economy is less energy-intensive than it used to be. The chart below shows that energy intensity is lower in richer countries (because they have a higher proportion of services) but energy intensity of GDP has been falling even for lower income economies, owing to growing energy efficiency (note that a lot more goes into energy intensity than just oil use). McKinsey analyses the decoupling of GDP growth from energy use here.

The US continues to station its Fifth Fleet in Bahrain, and Saudi Arabia is a key US ally (and buyer of American arms). But it is increasingly unclear why the US bears this cost (though it does provide a useful potential chokehold on China’s oil supplies from the Gulf).

The outlook for oil demand: it’s mostly downhill from here

On top of this now comes the expected long term decline in global oil demand arising from decarbonisation of ground transportation. The world’s major car companies are all now committed to replacing internal combustion cars with electric cars over the next 15 years or so. Trucks and airplanes may continue to use oil for a while longer because it is hard to find a successful replacement. And the petrochemicals industry will continue to use oil for a long time yet. But most energy forecasters agree that oil demand will peak this decade, followed by steady decline.

If supply is more or less fixed and demand is falling, then prices will decline. It may an uneven fall, as supply may also start to decline if the oil majors cut their investment in new supplies. But the trend seems clear: both the volume and price of oil are likely to fall over the next 20 years. This spells economic problems for countries that depend on oil exports, a trend which could become a major source of political instability.

The decline of oil politics may be replaced by the rising influence of other commodities. For example the narrow supply chains for the metals and rare earths needed in electric batteries may lead to new sources of national power and international tension. The international economy is unlikely to ever run smoothly.

The wisdom of Sheikh Yamani, whose obituaries recorded what a respected and thoughtful man he was, is best captured by what he may have said (there are varying reports, as so often with great quotations) in the 1970s: “the stone age did not end for a lack of stones, and the oil age will not end because we run out of oil”.

Leave a Reply