Single cause explanations of events such as Brexit or the Trump victory are too simple. But there is an important and worrying economic background fact to both, which is that the Anglo-US style of western capitalism seems to have stopped working for most people.

*

For several years I have been teaching a session for Cambridge Judge Business School’s Advanced Leadership Programme on the global economic and financial outlook. I make two points: i) there is nobody in control of the world financial system, which allows unconstrained flows of funds into and out of countries in a destabilising way; and ii) the US capitalist economy no longer works for the majority of Americans, at least judged by its ability to generate rising incomes. The second of these is more serious, because it’s likely to apply not only to the US but to other advanced economies.

The problem can be told in a few charts. (The solution is alas far more difficult).

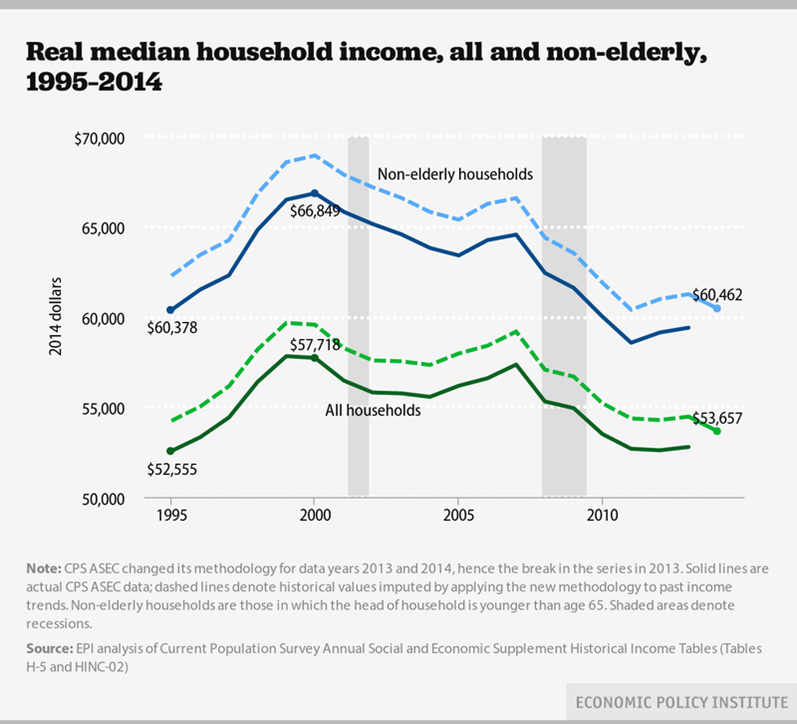

The first chart, from the Economic Policy Institute, shows that there has practically no real income growth for the median (middle of the distribution) US household in 20 years.

This is household data. We know also that levels of pay have been stagnant for much longer, going back to the mid-1970s. Many households sustain their income by having two people working, sometimes with more than two jobs between them.

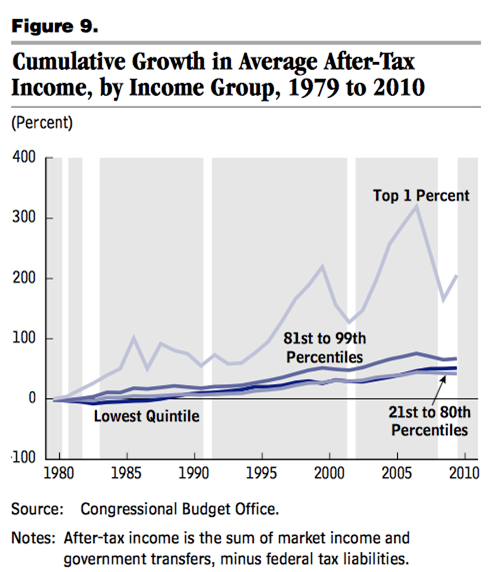

The stagnation in median income has happened while the economy has still been growing. Logically, this means the growth of national income has gone instead to the very high income households. Here’s confirmation of that in a chart from the Congressional Budget Office.

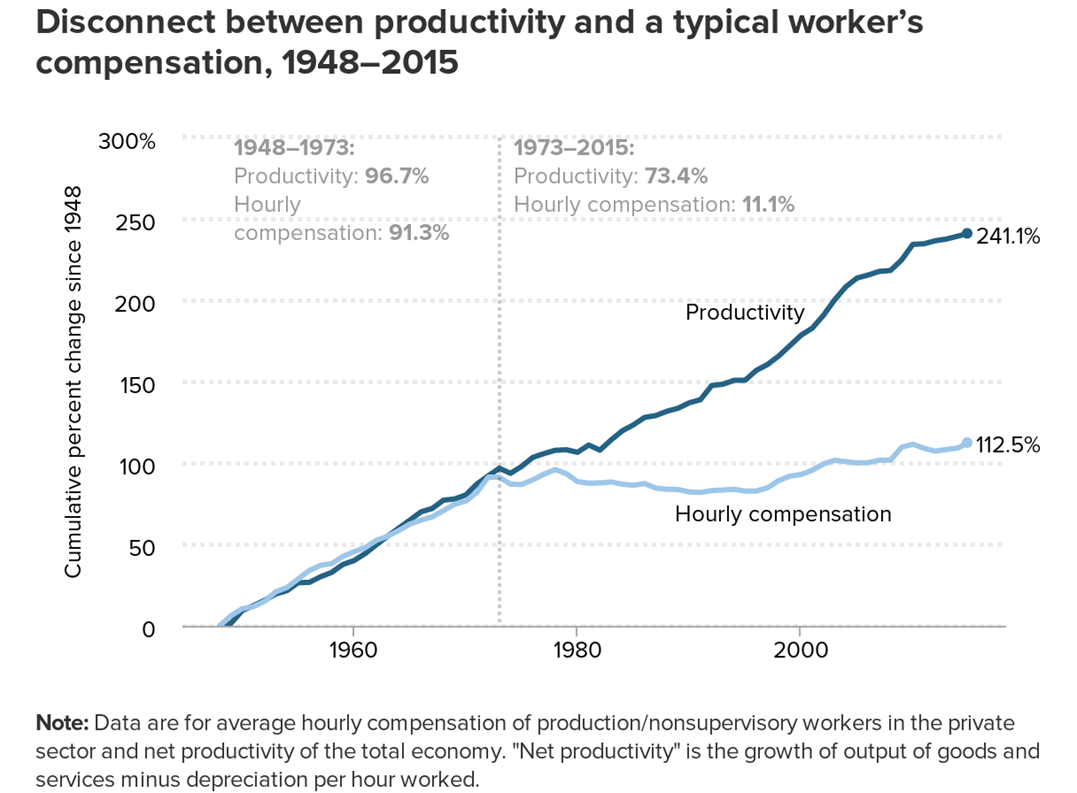

The problem is that the previous long term relationship between productivity growth, which is the fundamental driver of rising living standards, and pay, has broken down.

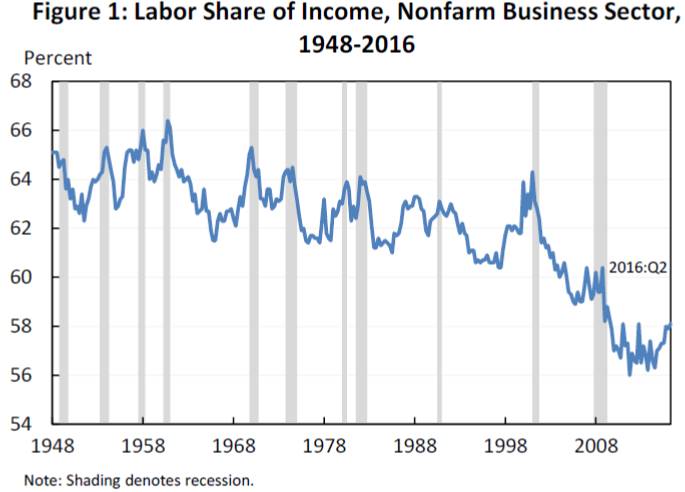

The further logic of a fall in pay relative to productivity is that the overall income distribution has shifted from labour to capital, which is indeed the case.

The US economy used to deliver relatively steady income growth for the majority of the people. There were recessions from time to time but the long term expectation was of continued growth in living standards. That has not been true for a generation. Currently many Americans fear for their children’s future and wonder what has gone wrong. It is hardly surprising that a lot of them reject a presidential candidate who appears to offer no prospect of change and who is closely associated with institutions and decisions which seem to have brought about or entrenched the model of US capitalism which works very well for the very rich, for Wall Street and Silicon Valley but badly for everybody else.

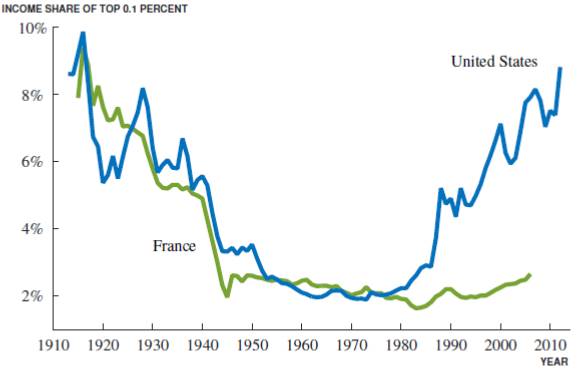

The fact that not every western economy has seen these trends gives hope that there is an alternative path, though it’s very unclear how we could get there. Here is the US compared with France.

The explanations of this profound change in the US system include: technology, growing concentration in several industries, the rise of China, the decline in unionism (partly brought about by deliberate policy), tax policies, the massive rise in CEO pay associated with inefficiently targeted executive compensation and the rise in the share of income taken by the financial sector, much of it in ill-deserved fees on asset management products. Economic research is a long way from establishing a consensus on the various contributions of these factors, some of which can be changed but not all.

Leave a Reply