A new theme in explaining slow growth and productivity and rising inequality: greater monopoly power in the US.

*

I’ve been thinking about my forthcoming teaching for the Cambridge Advanced Leadership Programme in June, which is always an interesting session, with a lively and challenging group of delegates from across the world. I try to combine three things in my module: i) an overview of where the world economy is at present; ii) a deeper structural view of the world financial system; and iii) one or two specific themes which are being discussed in the world of finance and economics research which are not yet in the wider public debate but which may contribute to understanding why the world economy is not performing as well as hoped.

The latest theme is monopoly power, or equivalently the concentration of supplier power in markets in advanced economies. This may be part of the explanation for three intertwined but poorly understood aspects of the advanced economies, especially in the US: i) slow productivity growth; ii) rising inequality; and iii) weak GDP growth that some call secular stagnation.

Textbook economics usually starts with perfect competition, a world in which nobody has any market power on the demand or supply side. The logical consequence of this is that resources are efficiently used. Firms are price-takers, meaning they just have to sell at the prevailing market price, which will be exactly the price that just incentivises the marginally efficient firm to keep producing.

Perfect competition is what in social sciences is known as an ideal type, a stylised model that helps us understand the world but is not necessarily realistic. There are some markets that are close to perfectly competitive, for example farmers often have absolutely no pricing power, though it’s often the case that there is market power on the demand side (supermarkets, agricultural purchasing boards in developing economies).

But most goods and services are traded in markets where there is some market power. This arises from the product or service being differentiated – it’s not identical to others so there is not perfect substitutability. Even location matters – a corner shop may compete in terms of being more convenient than a cheaper supermarket some distance away. Branding is a way of discouraging consumers from simply comparing the prices of similar products (even if they are in fact practically identical).

All this is fine within limits. You could even define the primary goal of any business to build some market power by making its product different. It can then potentially earn a slightly higher return and perhaps invest in product innovation which would be unaffordable in perfect competition. There is a virtuous circle in which companies innovate, differentiate, invest in further innovation and thereby produce better products for their customers, at the same time building some degree of market power.

The dark side of monopoly power

The problem comes if this market power is either unearned through successful innovation or service or even if it was, it allows a company to build barriers to entry which prevent other firms from competing. To an economist, the danger of monopoly power comes in two forms: i) the monopolist can and will price above marginal cost, so the price no longer reflects the true resource cost of production; and ii) the monopolist may stop being innovative and dynamic and instead become lazy and inefficient, secure in the knowledge that competitors offer no threat.

A related consequence of monopoly power is that firms are not under the same pressure to pay workers their marginal revenue product (the value of what they produce). If there is concentration on the employer side but lots of workers for hire then firms can get away with paying less than before. (Cambridge economist Joan Robinson suggested that this might be the source of what Karl Marx, using a very different and ultimately unsuccessful economic framework, called labour “exploitation”. Marxists generally disagreed with her approach but the long term predictions of Marxist economics have mostly failed to happen). So rising monopoly power might be part of the explanation for stagnating middle class incomes in the US and the trend of rising inequality in the last forty years or so.

In the long term, even secure monopolists tend to go out of business, because technology threatens most barriers to entry eventually. But it can take years. Microsoft was a de facto monopolist in PC operating systems for two decades. It now has a much smaller market share in computing because that now includes mobile devices, where Microsoft is not particularly competitive (despite Bill Gates having identified the threat from the Internet a long time ago).

Both the US and the EU have competition policies and enforcement agencies, which are known in the US as anti-trust, because the laws originated in the government’s largely successful attempt to break up the “trusts” which were monopolising many areas of the growing industrial economy in the late nineteenth century. Far from being anti-capitalist, competition policy is about ensuring that the market remains vigorously competitive, not dominated by a few large companies which prevent new entrants from offering better and more innovative services.

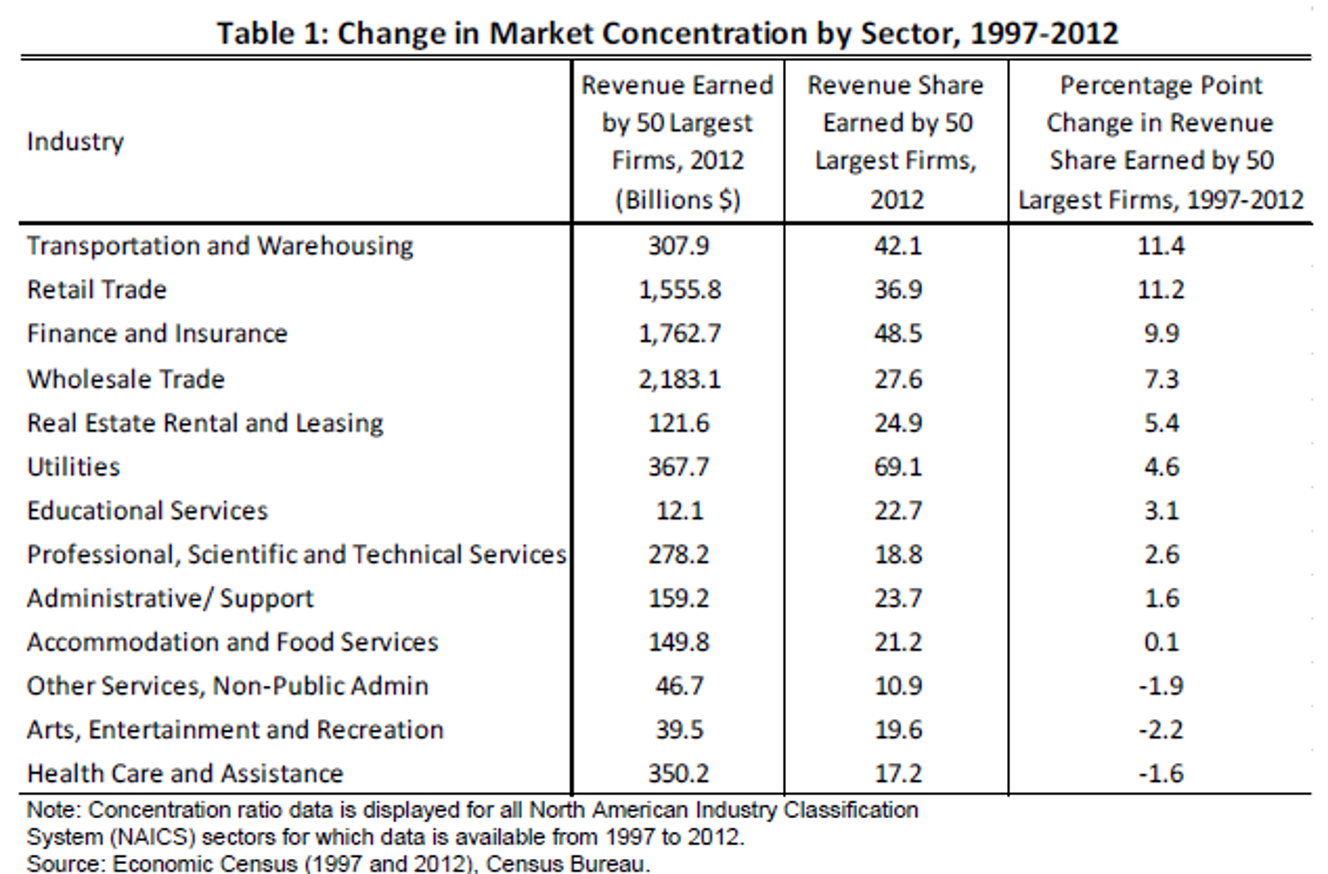

But there is a growing view that the US has eased off on that previous anti-trust pressure in recent decades. The Council of Economic Advisors to the US President (CEA) published an excellent briefing on this subject in April 2016. It shows higher concentration in several industries, meaning that the largest firms have an increased share of revenue compared with the past. Table 1 below shows that the largest firms in transportation and warehousing have seen an increase of 11.4 percentage points in their share of industry revenue from 1997 to 2012.

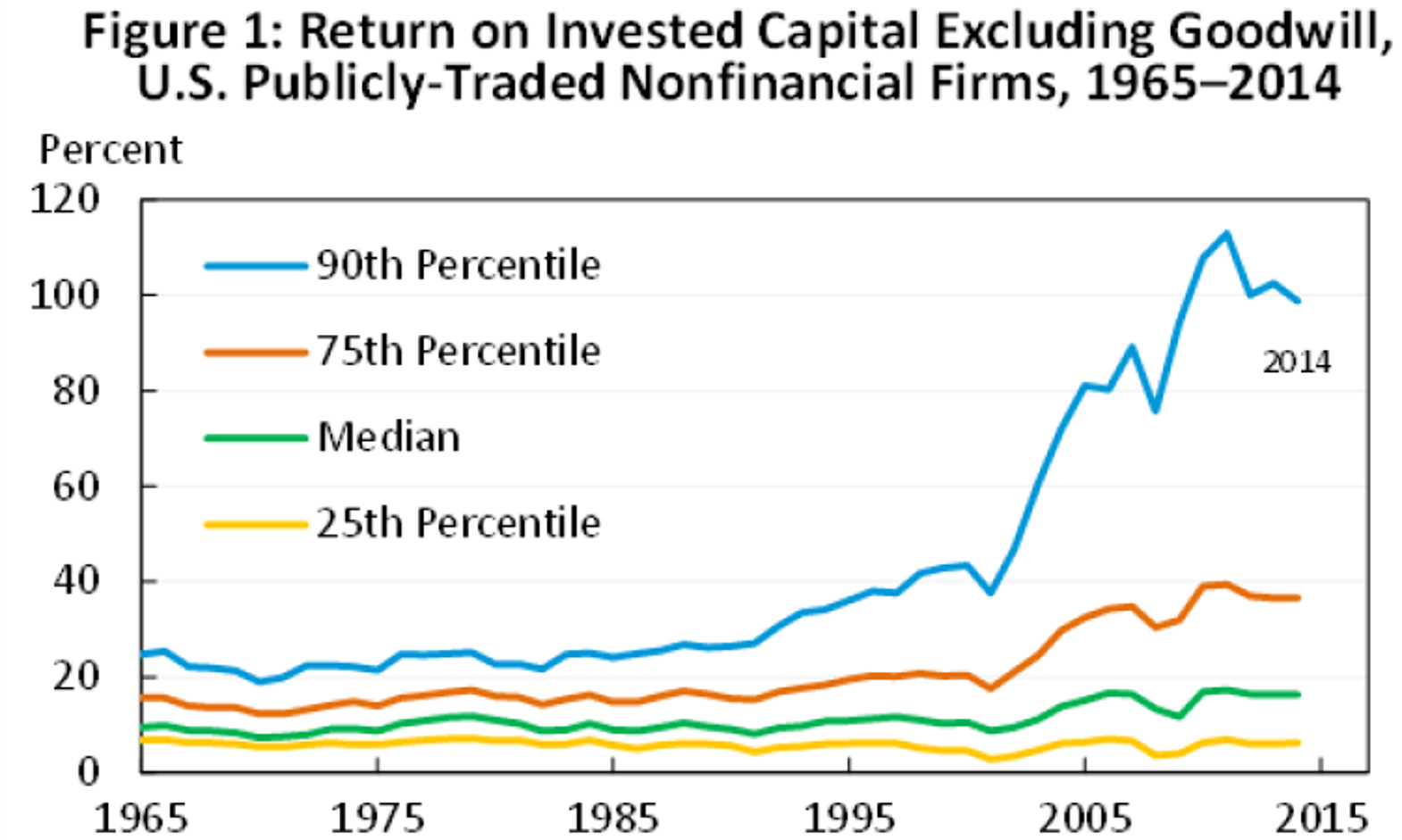

This is a measure of structure. What we really care about is behaviour. And the report shows rising profitability across the economy which may be a sign of increased market power. Figure 1 below (based on McKinsey analysis) shows that it is the most profitable firms which have become disproportionately more profitable (the 90th percentile means the company with profitability in the top 10%, ranking all firms). The ratio of the 90th percentile to the median firm (the one in the middle of the distribution) has rised from two times a quarter century ago to more than five times in 2015.

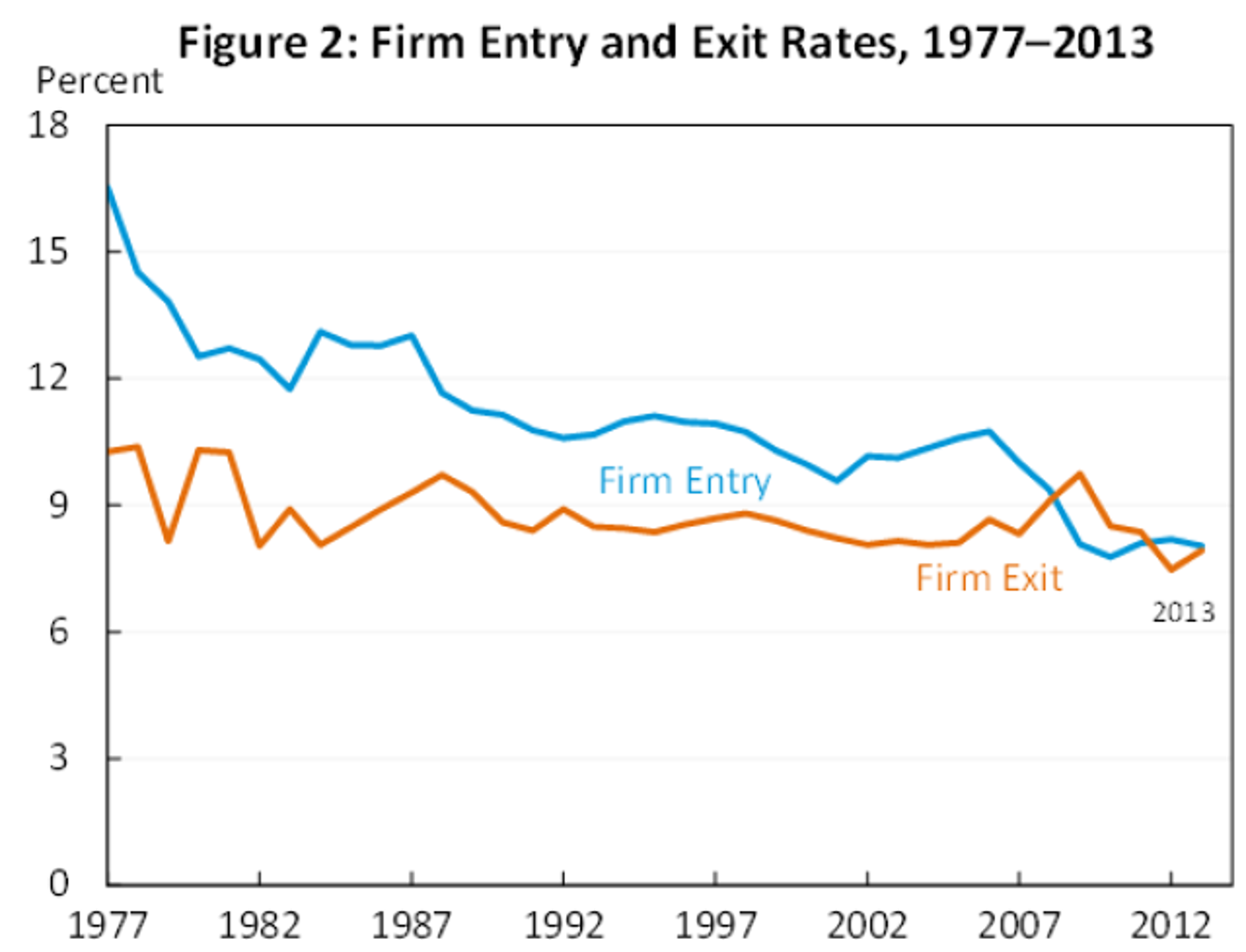

Further evidence that the economy may be suffering from lower dynamism is that levels of firm entry and exit have declined. This is consistent with incumbent firms being able to discourage or prevent new entry and entrench their power.

The report concludes: “consumers and workers would benefit from additional policy actions by the government to promote competition within a variety of industries. In addition, more work is needed to understand how policies that promote competition should be applied in the digital economy and other technologically dynamic sectors.”

The causes of this rising concentration of market power are not well understood but the CEA lists as possible contributors: “efficiencies associated with scale, increases in merger and acquisition activity, firms’ crowding out existing or potential competitors either deliberately or through innovation, and regulatory barriers to entry such as occupational licensing that have reduced the entry of new firms into a variety of markets.”

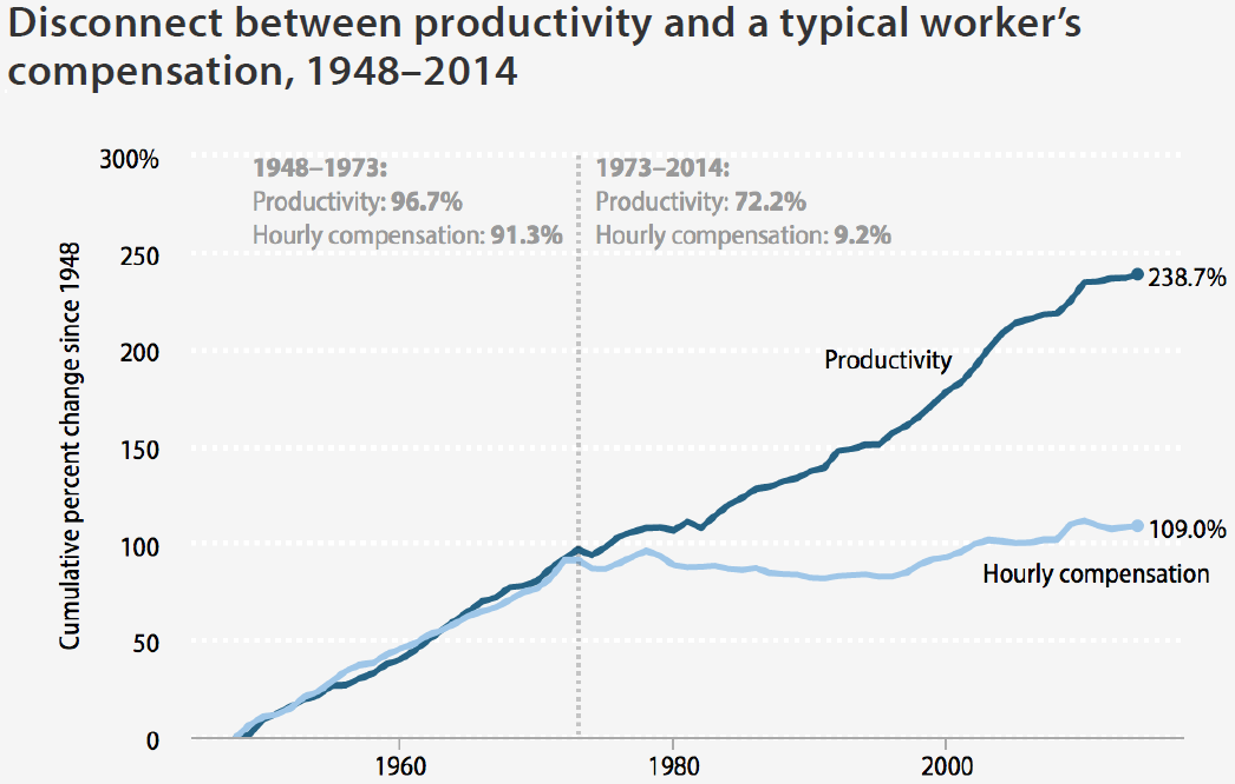

A 2015 report from the Economic Policy Institute documents how in the US productivity has continued to rise, though perhaps not as fast as before. But workers’ pay, which used to track productivity, broadly as the theory of perfect competition would predict, has diverged from it since the late 1970s. There are other likely causes than concentration (including declining union power, greater foreign competition and the vast growth of CEO pay, including but not limited to the finance sector). Here is the key chart from that report:

Conclusion

The goal of governments should not be to try to stamp out any deviation from perfect competition but to ensure that industries with high profitability have earned it through genuine competitive success, not by excluding competitors. It will always be hard to get this judgement right but the history of the US economy suggests that vigorous competition, reinforced by occasional but firm anti-trust interventions, is in the best interests of consumers and employees.

Rising concentration and higher profitability for the most profitable firms is consistent with the trend of stagnating wages (because profits are taking a higher share of national income) and of declining productivity growth (because these firms are less under pressure to invest for innovation). There are undoubtedly other causes too (changes in technology, especially those that reduce the need for skilled labour, and globalisation of trade leading to erosion of high paid manufacturing jobs in the US). But this is an area where government can actually do something.

Additional reading

Joe Stiglitz Monopoly’s New Era

Branko Milanovic 5 Powerful forces driving inequality

Jared Bernstein The productivity slump and what to do about it

Brookings Does the United States have a productivity slowdown or a measurement problem? (the answer is that it’s mainly a productivity slowdown – Simon)

Economic Policy Institute Understanding the Historic Divergence Between Productivity and a Typical Worker’s Pay

Review by Larry Summers of Robert Gordon’s book on declining productivity Will our children really not know economic growth?

Leave a Reply