You might find it odd that any country wants to join the Eurozone, given the continued mess the world’s second biggest economy is in. While the markets have stopped pricing in a high risk of the extreme event of a Euro break up, the macroeconomy of the Euro area remains terrible. A prolonged recession with disastrously high youth unemployment in several countries looks depressingly likely.

And yet yesterday Latvia was approved as the Eurozone’s 18th member, to join at the start of 2014. Estonia was the 17th, joining in January 2011. Why do these small, very open economies want to join what to many looks like a ship that may not be sinking anymore but shows little sign of getting back to full speed?

A short, insightful piece from the Peterson Institute tells us why. Latvia suffered very badly in the aftermath of the world financial crisis, partly because it lacked a lender of last resort. With an economy dominated by Euro transactions, Latvia was unable to offset the collapse in liquidity that many countries faced, because it didn’t have access to the European Central Bank. For all of its macroeconomic failures, the ECB does its duty as a proper central bank and would, from next year, be able to provide Latvia with emergency liquidity if needed in future.

Latvia and Estonia have had dramatic falls then rises in GDP since the crisis. Some have pointed to them to show what Greece, Portugal and Ireland have failed to do, namely to dramatically cut wages, rein in government spending and go for rapid, painful adjustment. This isn’t entirely fair on the Southern Europeans (Ireland is actually somewhere in between, having done more to adjust its wages than the other peripheral nations, though it still has very high unemployment). It is hard to draw many conclusions from such small and very open economies as the Baltic states. Greece, for example, faces a question of what more it could export in the short term, even if it did regain competitiveness through lower wages (which is gradually happening)? Greece needs macro adjustment and a lot of structural change, something that could take decades. Meanwhile it can cut imports by depressing incomes, which it has done, and hope that there is a surge in tourism, perhaps helped by the discouraging turn of events in Turkey.

Ireland has received praise for the scale of its wage cuts and fiscal stringency. But it still has a lot to do before it has a sustainable government financial position. Meanwhile its people have reacted to their disaster with a resilience and calm that looks admirable compared with Southern Europe (perhaps it’s the climate) but the sad return of emigration is acting as a safety valve for unemployed skilled people.

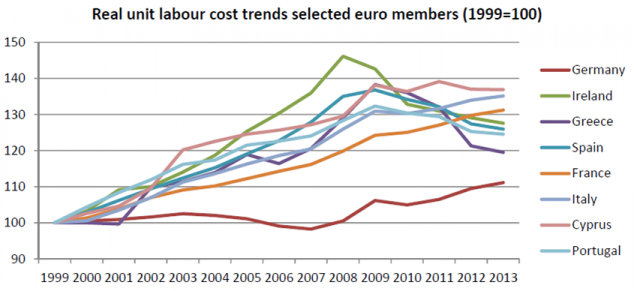

The chart below, from an interesting report from the OpenEurope think tank, shows the scale of the initial rise in costs in several Euro countries relative to Germany, and the partial improvement in the last couple of years. Greece is still about 10% less competitive relative to Germany than at the start of the Euro but it has closed the gap by nearly 20 percentage points. Ireland’s huge cost increase relative to Germany has been substantially repaired to but there is still some way to go (this data is a few months out of date so there has been some additional improvement). Spain and Portugal have made good progress too. Italy, by contrast, is still moving in the wrong direction.

The Euro mess (it’s not correct to call it a crisis, this is a continuing and relatively stable state of affairs) is a social disaster. Latvia and Estonia no doubt see this but have their own good reason for wanting to harness their economies to it. Just because the club is getting bigger shouldn’t lead anyone to think that it’s well designed.

Leave a Reply