On 30 November 2015 the IMF voted to include the RMB (the Chinese “people’s currency” denominated in yuan) in the basket of currencies it uses to calculate the value of the Special Drawing Rights, from October 2016. This is largely symbolic but should encourage further international financial reform in China.

*

What does it actually mean?

The IMF (International Monetary Fund) was set up in 1944 as the key institution of the Bretton Woods international monetary system, named after the town in New Hampshire, USA, where the treaty was signed. The IMF was created to police the system of fixed exchange rates and international capital controls which defined Bretton Woods. It also provided emergency loans to countries in temporary balance of payments difficulties, allowing them to maintain their fixed rate or, sometimes, to change the rate in a controlled way.

The Bretton Woods system ended in 1971 when the US stopped making the dollar convertible into gold and the large economy exchange rates started floating (their values determined continuously by market forces). The IMF had lost its main purpose but carried on as a supplier of emergency government funding. During the long period of the “great moderation” up till 2007 it seemed to be heading for obsolescence and was cutting its headcount. But the global financial crisis gave it a new and much expanded role (see this blog). It is the nearest we have to (though it’s still some distance from) a global central bank.

The SDR – special drawing right – was created in 1969 as a new reserve asset. Reserve assets are held by governments (usually by their central banks) as a form of saving against the risk of financial turbulence of the type seen in the Asian financial crisis of 1997. Reserves are foreign currency assets that can be used to settle debts or pay for imports at a time when normal access to foreign currency is restricted or unduly expensive. The leading reserve asset by far is the US dollar. This is because a reserve asset needs to be safe and liquid, so that it can be available at short notice. The biggest pool of such assets is US dollar bond issued by the US government and related agencies such as Fannie Mae and Freddie Mac, which are regarded as, in effect, government backed.

In the 1960s there was a brief period when the world’s demand for dollars (for use as reserve assets and for international trade) exceeded the supply (which comes from the US running balance of payments deficits). The SDR was created to fill the gap. Its odd name was intended to satisfy US government pressure to make sure that it didn’t appear too much like an alternative currency. It is not actually a liability of the IMF (unlike currency, which IS a liability of the central bank which issued it). It can only be used by governments and central banks. And it provides IMF members with a claim on actual currencies, in a defined ratio. It was largely obsolete by the time it was created and has had a minimal role in international finance ever since, though it is used by the IMF as a unit of account for its transactions. in 2015 Greece controversially used its SDR allocation to pay the IMF part of the debt it owed (see this blog).

The SDR is currently defined as a basket of the dollar, yen, euro and pound. The criteria for including other currencies are i) the currency is widely used in international trade; and ii) it is “freely usable”. The RMB obviously satisfies the first criterion (China is the world’s largest exporter) but the second is not so clear. The IMF was under some pressure to include the RMB in the basket because China is the world’s second largest economy and because it wanted (with US support) to encourage those forces in China which support further liberalisation of the Chinese financial system, including internationalisation of the RMB (see this blog for more).

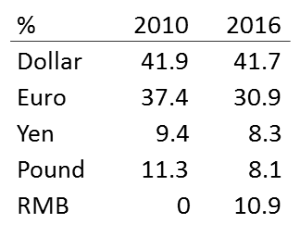

The new weights (and the previous weights agreed in 2010) are shown here:

So what difference will it make?

The SDR has no significant role in international finance so inclusion of the RMB will have no impact on international trade and very little difference in reserves. Use of the RMB in trade payments is rising but, as Chris Balding of Peking University points out, that’s dominated by trade involving Chinese firms – the flows are overwhelming in transactions with China, Macau, Singapore and Taiwan. (Chris Balding’s blog is essential reading on the Chinese economy). The RMB is not used in trade between non-Chinese parties, unlike the dollar, which is very widely used in payments between countries other than the US.

Countries’ decide on what reserves to hold using the criteria mentioned above: safety and liquidity. The US dollar provides the lowest country risk with large, deep and liquid capital markets. So a country can liquidate even very large amounts of its reserves at short notice. That is not the case with Chinese financial markets. Access to these is restricted (though China now allows central banks access to the inter-bank bond market). And the markets aren’t that big or liquid. China’s credit risk is low but not as low as the US.

There are some central banks that already hold some reserves in RMB form but (as Chris Balding also points out) they are held in the form of swaps with the Chinese central bank, the People’s Bank of China. That means those central banks don’t have complete control over the reserves, which can be suspended by the PBOC. These central banks probably hold the RMB more as a political gesture of support for China, rather than as a part of a true reserve management strategy.

More generally, the market for RMB outside China (the “offshore” market) is still partially controlled by the PBOC. There is a small pool of RMB deposits, mainly in Hong Kong, but otherwise access is through Chinese commercial banks which are under the control of the PBOC.

The future?

There is no doubt that the Chinese government wanted the RMB included. This is one of those rare events where everybody (including the US) agreed it was a good idea. Well, some people believe the IMF has somewhat compromised its technical criteria in order to achieve a diplomatic outcome but that has happened many times before with the IMF (most recently with the unjustifiably large loans to Greece).

Symbolism can still be important. If China continues its slow but so far steady path towards the internationalisation of the RMB then it could mean the RMB genuinely becoming a reserve currency in ten years or so (Japanese bank Nomura has reportedly said they think it will happen by 2030). That would require China’s domestic capital markets to become larger and more liquid too. The world could certainly do with another credible reserve currency. The current domination of the dollar has perverse results such as a flood of funds into the US even after a financial crisis that was rooted in the US. If the euro could become credible too then there would be three reserve currencies, which might help stabilise the world financial system and facilitate international financial diplomacy.

But for any country’s currency to become a reserve currency requires that country to give up control of its exchange rate and abolish capital controls. China’s government appeared to show during this summer’s stock market turmoil that is does not like giving up control. If investors believe that China will reimpose controls when it feels like it, then they will not treat the RMB the way they treat the dollar.

So the big question remains, in respect of both domestic and external financial reform, is the Chinese Communist Party really willing to give up control of the financial system?

Leave a Reply